We often assume organizations should always find ways to accelerate growth whenever and wherever they can. But is this really the best way for organizations to operate? Growth is essential—no doubt about that. But what do firms really mean when they talk about growth? What type of growth should your firm try to achieve, and will you approach it the right way?

We often assume organizations should always find ways to accelerate growth whenever and wherever they can. But is this really the best way for organizations to operate? Growth is essential—no doubt about that. But what do firms really mean when they talk about growth? What type of growth should your firm try to achieve, and will you approach it the right way?

While a common tactic is to buy growth through mergers and acquisitions, not all firms are positioned to do so.

We find that members of our vast client base carry different growth objectives on varying time scales. Some concentrate their efforts on expanding top-line revenue in the short term, while others prioritize growth in their margins through longer-term initiatives.

In the case of smaller, newer organizations, they want to see the classic “hockey stick” in their margins. They are laser focused on simply drawing as many users to their brand or platform as fast as possible.

None of these goals are necessarily better than the other. What is important, however, is that they are aligned to the firm’s broader strategic vision. As our very own Don Turner noted in the Spring 2019 issue of The Jabian Journal, strategy is most effective when there is robust governance that drives strategic planning, which, in turn, allows strategic insights to infuse the organization’s day-to-day operations.

Ideally, the firm’s short- and long-term strategies are built on its strengths, making its growth goals a reality. Here, we explore four mechanisms to consider before diving in and building your own growth strategy.

Acquisitions

A majority of the companies engaging in M&A activity have a strong understanding of the market. Knowledge of the current landscape is table stakes. Not only do they know their immediate market, but they invest heavily in due diligence, understanding an acquisition target’s market like the back of their hand.

Things get interesting when companies must forecast the growth potential to become comfortable with how likely and sustainable profit will be in the foreseeable future. One frequent blind spot for acquiring companies is the future intensity of competition. What does the competitive landscape look like now, and what is likely to come?

Sure, organizations will account for a risk factor, but even the aggressive end of that spectrum tends to be undervalued. When M&A deals are announced, firms should always anticipate a competitive response—not only from their existing competitors, but also from new market entrants. Companies sometimes overlook this aspect of due diligence.

We have seen a number of M&A transactions kick off 2019 in Jabian’s core markets. In the financial technology space, Fiserv and First Data joined forces to become one of the world’s leading payment and financial technology partners. This move was intended to increase scale and expand the combined companies’ footprint in high-value client solutions. According to their press release, these expanded capabilities will lead to revenue expansion, driving at least $500 million in revenue synergies.

Staying with the finance theme, BB&T and SunTrust joined forces to become the sixth largest bank holding company in the United States. While the combined revenue is apparent, one prominent growth play for this transaction, as noted in their press release, was profitability growth through cost synergies. Achieving these synergies will take careful planning and precise execution.

During an M&A assessment, IT systems and shared services are the first areas identified as opportunities for cost synergy, but this shouldn’t be just assumed to come into fruition. You need a proper program or management office to take the reins, manage the integration, and drive the result.

Without a tactical plan to orchestrate all the moving parts, you are leaving the integration to chance. Without integration, there are no synergies. Integration synergy is just one of many forecasted benefits of a merger. To achieve the original planned results, a formalized structure—mapping the forecasted value to the benefit hypothesis (Figure 1)—is essential.

Figure 1

New Markets/Customer Acquisition

When was the last time your organization considered entering a new market by targeting a new customer base? This question challenges some firms because they tend to prefer to take a conservative approach to growth. More established companies that are more risk averse tend to pull all the other growth levers before they start looking for a new target market.

For example, they will raise prices on their products or increase marketing budgets to show more of the same advertisements in hopes of capturing more of their core market segment.

Why don’t companies commonly explore new segments? Because it’s difficult. It’s easy to want to stay “true to your brand” and stick to what you know. But the reality is that almost every business needs to develop the internal capability to analyze new markets and assess whether they should work to acquire new customers across new segments.

For example, look no further than the new messaging from some of the world’s most iconic brands.

After five straight years of retail sales decline, Diet Coke recently debuted a modern look, added flavors, and released a new “Because I Can” campaign that reminds its new target market that they should think about doing what makes them happy—no matter what anyone else thinks.

Make no mistake: This modernized campaign was created to appeal to a new segment that wasn’t even born when Diet Coke first launched in 1982. It was important for the organization to reframe the brand in a “youthful, energetic, and aspirational tone.”

Delta Air Lines—with its effort to expand revenue among business travelers—is another great example of the importance of understanding when and how to analyze a new market segment. As noted in a recent investor day presentation, Delta’s marketing executives believe flyers under the age of 35, or what Delta likes to refer to as “emerging high-value customers,” will account for 50 percent of their business customer sales by 2020.

While it will be increasingly important for Delta to continue to sell airline tickets to this segment, the company’s key insight centered on the products these customers purchased. Delta saw that this new segment may be 60 percent more likely than others to upgrade to premium products. Further, they know how important a solid Wi-Fi connection is to this customer group, so they’ve made significant investments across their fleet to appeal to this audience.

Jabian recently worked with a health care technology firm to explore where they could find new business. Our client had a long, successful history of serving a core segment of the health care market, but with new regulations, an evolving health care ecosystem, and significant reconciliation in the market, they needed to find ways of getting creative to identify a new target market.

It all starts with an analysis of the market landscape and a customer segmentation exercise. If you’re finding that your current segment is saturated, identify adjacent market segments your firm can pursue. Investigate what components or features of your product would need to be adjusted to serve that market well.

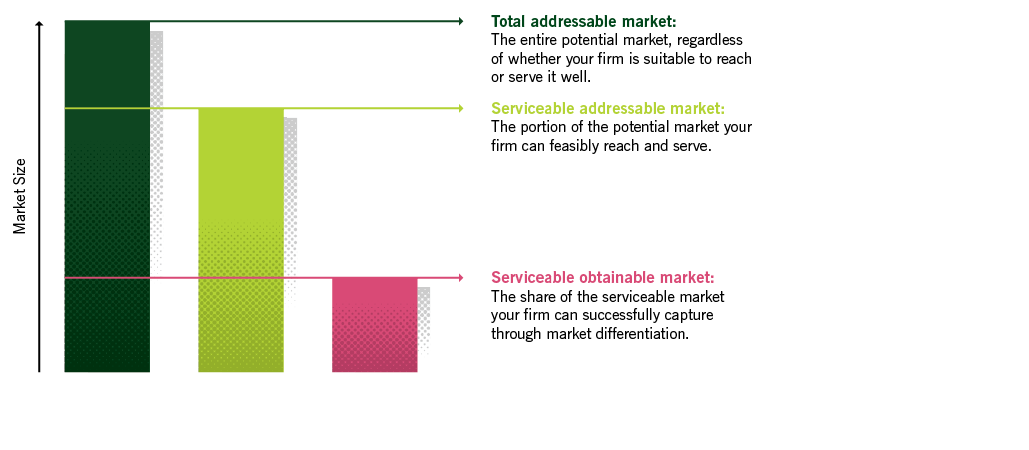

To convince yourself and others in your firm that an opportunity is worthwhile, you’ll need to conduct a robust, top-down (Figure 2), and even perhaps a detailed bottom-up, market sizing effort to properly know what opportunity your firm truly has.

A bottom-up framework is highly tailored to the organization and its current situation. The first step is to understand the company’s capabilities and its market specifics in order to make assumptions about which customer segments an organization can reach. Based on market trends, it will be important to appropriately refine the addressable market and determine how many of those customers the firm can convert.

Figure 2

A top-down framework

Innovation

Innovation has almost become synonymous with growth. In the era of wanting to be at the bleeding edge of technology, many firms assume innovation is restricted to the unicorn start-ups that turn into gold mines. Further, it has been common to see the term innovation tagged to the development or management of products, software, or offerings.

The reality is that innovation is not only relevant, but essential in almost every area of your organization. The key is to ensure that the firm has a consistent framework for innovation—one they can rely upon when they need it most. Want to prioritize growth? Innovation should be at the forefront of these functions:

Business strategy:

Assess new business model options and how they fit with your current business.

- Recurring revenues through subscription versus one-time fee structure.

- Shared economy model.

Operations:

Re-engineer your processes to enhance efficiency and sell products at higher margins.

- Find opportunities for automation through RPA.

- Determine where it makes sense to launch a shared service across the enterprise.

Product:

Address gaps between current offerings and market demand.

- Create new products/offerings to fill a void in the market.

- Enhance existing products with new features.

Customer:

Identify new ways to truly delight your customer.

- Understand the end-to-end customer journey.

- Reimagine the customer experience and how you want to connect with them.

Now you know where you can innovate, but is your firm set up to execute? You may be wondering where and how to source new ideas. You may be surprised at the sheer number of ideas that can come from within your organization. Chances are, those who lead and manage day-to-day operations across functions will be more than happy to offer their thoughts.

The challenge is in how to triage those ideas. How do you vet them in an organized manner? How do you prioritize them? And how do you nurture the best ideas from inception to implementation?

Setting up the right governance model makes all the difference. The model must empower the individuals within your organization to put forth their best ideas, while providing the right resources to coax those ideas

into fruition.

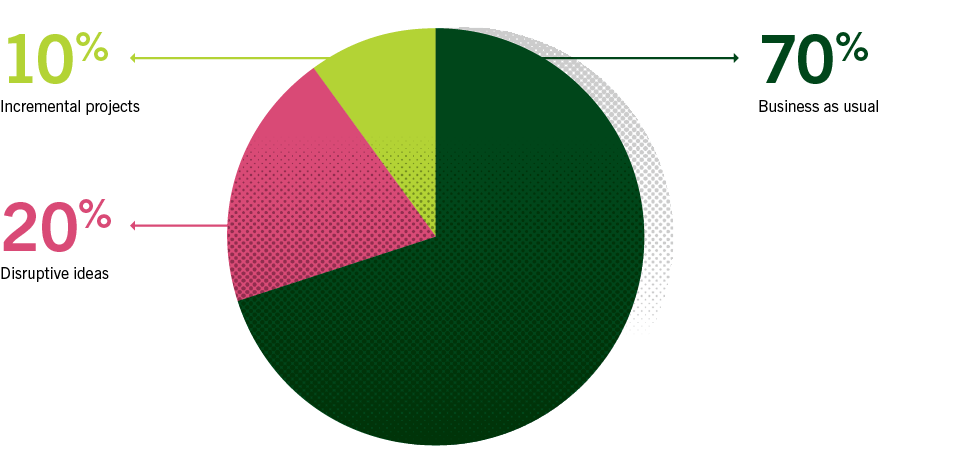

Where to place your bets? (Figure 3) A majority of your budget needs to focus on your core strengths. Chances are, that means dedicating most of

the funding to your “business as usual,” day-to-day operations. You may see opportunities for incremental improvements—things that allow your firm to produce the same things, but slightly cheaper, faster, or better.

But unless you foresee a big return on those improvements, you’re likely better off investing more on bigger, disruptive innovations. Before you invest in the programs that will disrupt the market, make sure you’ve set the team up for success. Innovation requires investment and it doesn’t happen overnight.

If you don’t commit to a dedicated team to focus on innovation and set up a structure to protect them from competing projects, you’ll run the risk of significantly hampering their progress.

Figure 3

Budgeting for Growth

Strategic Partnership

It takes a village to run a successful business, and more often than not, you rely on third-party partnerships to give you a competitive advantage. You can probably list a handful of partners you’ve worked with in the past few months, but does your organization have a true purpose and vision for what that partnership should be?

Third-party interactions can be draining. You want to make sure your teams are getting the full benefit from these relationships. For partnerships that are already established and formalized, it’s essential that your team understands the framework used to evaluate and track whether this partnership is materially contributing to your firm’s strategic goals.

For areas where your firm has significant gaps in the market, have you conducted a market assessment to understand what new alliances could be established to fill those gaps? It’s important for the time your teams spend with partners to be purposeful. Every interaction should have an objective with a tangible outcome.

Perhaps some partners will help you grow through a new sales channel. Some partners may help you generate new leads. And some are simply best equipped to help you optimize your positioning in the marketplace. However, to achieve the right outcomes, the structure of your agreements with your partners should incentivize both parties appropriately.

Addressing the points above—coupled with a framework to outline the roles of each of your partners and criteria to evaluate progress—will ensure that you are getting the most out of your partnerships.

If any of these areas seem like a significant gap within your organization, you’re likely missing growth opportunities and wasting valuable time with your partners. Invest the resources to build a plan to address these. Build a strong foundation for your partnership strategy.

Evaluate your firm’s strength and position in the market to identify the right approach for your growth. Once you decide which growth lever should be pulled, get key stakeholders on board to ensure that your firm has the right capabilities to execute.