Until recently, U.S. colleges and universities had floods of students seeking enrollment. From 1997 to 2011, postsecondary enrollment rose 45 percent,1 and the number of colleges and universities increased from approximately 3,500 to 4,700 since the early 1990s.2 During the boom times, schools made significant investments in campus and student experiences with new residence halls and fitness centers and increased the number of nonacademic administrators. However, the days of expansion have come to an end for many schools. Funding has been reduced from government sources and endowments, while enrollment has been declining every year since 2011.3

Challenges Facing Higher Education Leaders Today

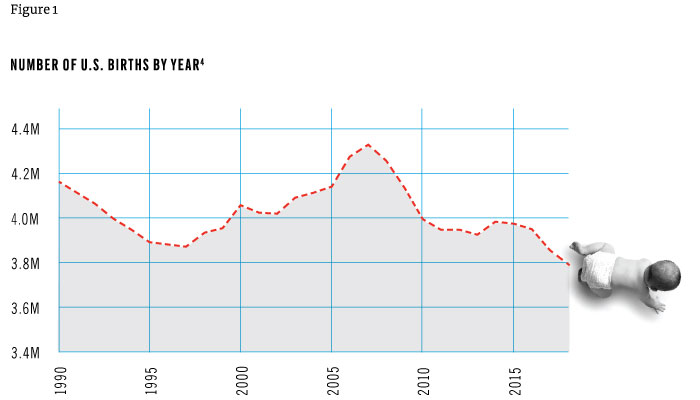

Looking ahead, the future does not look much brighter. When the financial crisis struck in 2008, the birthrate also took a hit amid economic uncertainty, and that decline has persisted over the following decade (see Figure 1 below).

With this decline in birthrate, U.S. colleges and universities will have to contend with an enrollment cliff—meaning the population of college-age students will plummet 18 years after the birthrate decline began.

Additionally, student loan debt is a major concern for incoming students. While today, 1 in 4 Americans have student loan debt, totaling a staggering $1.53 trillion, the next generation of college students is taking an opposing stance and opting out of financial assistance through loans.

In fact, only 11 percent of incoming freshman are willing to go into debt to pay for college. To avoid debt, students are selecting more affordable, cost-effective schools and looking for options to tailor a payment plan to fit their circumstances.

Schools face mounting pressure to make college more affordable and to operate within tightening financial constraints and with reduced staff in the business and finance office, all while an enrollment cliff looms. At the same time, administrators are also trying to deliver on student expectations for consistent, intuitive, easy-to-use, and seamless technology driven interactions on campus. With more seamless interactions, the amount of data that the school must protect while maintaining compliance with regulations continues to grow. In addressing these competing priorities, school administrators must orchestrate an efficient business model that supports student enrollment, retention, and engaging experiences.

This article outlines strategies for schools to accomplish the following goals: seamless and transparent financial interactions, flexible tuition payment plans, supporting services to keep students in school, and data security. The foundation for these strategies is a centralized and integrated platform, which enables schools to automate processes, tighten integration across systems, leverage managed services, and create more time for staff to provide guidance to students. Deploying these strategies can help schools remain viable while enriching the student experience.

Create Seamless Campus Interactions with an Integrated Platform

Today’s students expect payment interactions and experiences not only to be high tech and mobile-enabled but also tailored to their needs. These interactions can range from tuition and fee payments, to purchasing textbooks, to renting a tennis racquet at the recreation center, to buying a burger at the on-campus restaurant chain, to paying a parking ticket. This myriad of interactions involving multiple vendors can result in a disconnected payment ecosystem. A fragmented set of interactions can lead to inconsistencies in the options available to pay and result in chaotic reconciliation and reporting during back-end processing. As technology advancements, security requirements, and student expectations rapidly evolve, campus payment systems must do the same.

To combat the inconsistent payment and processing experiences, schools need the capability to connect all vendors, payment channels, processing, reporting, and even physical access points across campus into one centralized platform integrated with the Student Information System (SIS). This type of centralized platform and integration enables students to select their preferred payment method, which is often a card or device, and simply tap that device to make purchases. This frictionless interaction should be replicated no matter what type of device a student uses, whether it be to check that financial aid has posted, pay tuition and fees, access student housing, register for campus events, or reload their balances for on-campus purchases.

While this integrated, centralized platform meets student demands of a consistent and convenient experience when engaging with on-campus commerce, it also gives school administrators clear visibility into all the money and transactions that pass through campus systems. With increased transparency of expenditures, schools are in a better position to identify opportunities for efficiencies. For example, a school may find opportunities to reduce credit card processing fees or penalties by evaluating the types of transactions across campus.

A centralized platform removes the manual tasks involved in reporting and reconciliation, which can include the consolidation of data from multiple sources, manual manipulation, and management of data that has changed since the last extract from one of the source systems. Instead, automated reporting capabilities can pull real-time information into dashboards that display the right level of detail for making financial decisions. Not only do finance leaders have the information they need at their fingertips, but the automation capabilities also free up staff from transactional activities and allow them to focus more on serving students.

Help Students Manage the Cost of Higher Education with Flexible Payment Options

The burden of graduating with a mountain of debt is an unattractive proposition for today’s students. Instead, many want to minimize the amount of debt they incur. However, they will still need payment options to cover the remaining balance. To help students meet the challenge of paying for their education, most schools offer tuition payment plans to spread out the costs during each term. However, these plans normally come with prescribed cadences for payment and do not take into consideration a student’s unique financial context and needs. While schools may desire to offer flexibility, they may also be limited by software capabilities or the daunting task of managing tailored plans manually. Fielding questions unique to each student and tracking payments can be so labor intensive that schools are forced to offer only fixed payment schedules with little-to-no flexibility for students. This lack of flexibility could prevent a student from staying enrolled if the payment schedule is too challenging for that student to meet.

Leading colleges and universities can offer flexible tuition payment plans by leveraging a payment plan solution that is fully integrated with the SIS, automates plan management, and provides self-service tools for students. The integration allows students to select a payment schedule that works for them within the parameters set by the school. In addition, automated tools and communications provide students with real-time information about their accounts. For example, account balances refresh as soon as a student adds or drops a class, makes a payment, or receives financial aid. Automated communications notify students when balances change, send reminders for due dates, and confirm that payments are received. The self-service tools, communications, and integrated platform provide students the flexibility and ease of use they desire and lift the burden of managing plans away from the finance office staff.

In some cases, schools want to leverage a centralized platform to offer flexible payment plans but still want to ensure that students will be able to reach live support when needed. Schools who seek this type of service should select a third party to provide the software and services to manage student questions and provide answers that reflect up-to-date information.

Keep Students Enrolled While Generating Revenue

While students are working hard to stay on track with their payment plans, it is likely that some students will miss payments and have their accounts marked as delinquent. While many schools want to work with students to get them back on track, staff are often forced to manage and track delinquent accounts through manual updates to spreadsheets. This type of manual process can introduce errors and is time-consuming for staff who may already be at capacity with other priorities. As a result, some students may receive inconsistent communication about balances due; in other cases, schools may inadvertently delay actions on delinquent accounts for several months. When delays of several months occur, those students with outstanding balances likely have left school—many of which may never return. With outstanding balances still on the books, schools typically see no option other than sending the student balance to a collection agency. When students are sent to a collection agency, less than 1 percent re-enroll in school. In these cases, the collection agency’s fee, typically 25 percent of the balance, becomes either an increased burden for the student or lost revenue to the university. Those students also must bear the burden of damages to their credit scores, likely for years to come.

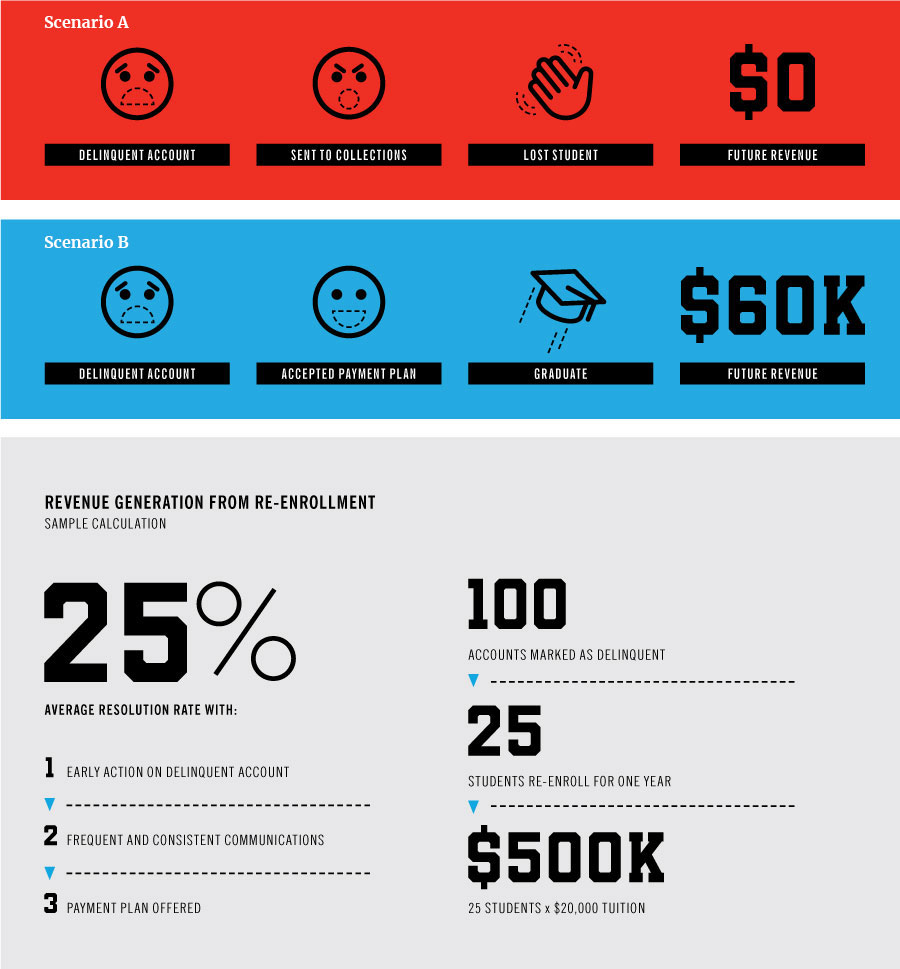

As schools contend with declining enrollment and the increasing cost of recruiting new students, forward-thinking schools are relying on third-party software and service solutions to help identify delinquent accounts as soon as they occur. Initiating a recovery process after the drop/add period and the posting of financial aid is the optimal time to resolve issues, as students are still enrolled. A trusted partner can serve as an extension of the school’s internal team by advocating for students and helping them resolve past-due balances. By applying this strategy, an average of 25 percent of students with delinquent accounts re-enroll when they receive timely communications and have an opportunity to establish new payment plans, which is a far better result than the 1 percent of students who re-enroll when sent to collections.

Using software that integrates with the school’s SIS enables staff to mark accounts as delinquent, initiating the resolution and recovery process in a timely manner. At that point, the software transfers detailed information needed about the student’s balance to a third party to manage. With this detailed information of what the student owes and why, alongside visibility into any changes in the balance, the third party can provide accurate information through a consistent cadence of communications that follow regulations set by a state or governing board. This combination of software and service can reduce the staff’s workload of managing delinquent accounts by 95 percent and give them more time to attend to the students that may be lining up outside their offices.

With a dedicated team focused on resolving issues, schools retain more students through graduation and generate revenue that would otherwise have been lost when a student leaves school permanently.

Consider the Following Scenarios:

Scenario A:

When a student with a delinquent account is sent to collections, the future revenue from that student is effectively $0, and the relationship with the student is most likely destroyed.

Scenario B:

If a student with a delinquent account can pay off an existing balance and re-enroll, the school continues to generate revenue from that student. Consider a college freshman who accepts a payment plan offer and re-enrolls for three more years at $10,000 per semester. In that case, the school generates $60,000 in revenue and produces a graduate—and potentially a future donor and supporter.

Focus Staff on Students and the Financial Health of the Institution

As schools face financial constraints, business and finance offices have frequently found themselves understaffed and/or bogged down with manual, repetitive, and time-consuming tasks. From manual updates to spreadsheets, tracking payments, journal entries, reporting, reconciliation, completing SAQs for PCI compliance, and answering calls about tuition balances are all competing for time from the finance office staff. As finance leaders cope with the mandate to “do more with less,” the need to streamline processes and shift away from transactional tasks to more advisory and strategic financial work becomes increasingly necessary.

By implementing automated tools, processes, and managed services for routine interactions, finance staff can focus more of their attention on students and issues that require more complex problem-solving and analysis. As the finance office transforms processes and procedures, higher-value activities aimed at delivering a positive student experience will replace manually intensive tasks, such as:

- Providing programs and guidance geared toward increasing financial literacy skills to serve students as they address the financial challenges of higher education and develop the skills they can employ post-graduation.

- Working directly with students to help solve complex financial issues, such as ensuring they can complete applications and provide required documentation to help maximize the financial aid available to them.

- Developing proactive plans for assisting students with enrolling in and paying for subsequent terms.

Dedicating time to these efforts elevates the position of the finance office to one of advocate and counselor for the students.

Finance leaders can also dedicate more time to Financial Planning and Analysis (FP&A) activities and issues directly related to the financial health of the university. Increasing visibility of the financial information from transactions across campus can aid in schools’ decision-making and help identify opportunities for cost savings or service optimization. Operating in a transformed office should allow finance leaders more time to focus on driving operational efficiencies, analyzing investment opportunities, and evaluating the projected financial impacts of proposed projects. As the competition for students increases, cost containment and strategic investments that add value for students will be critical differentiators and, for some schools, will be the difference between continuing operations and consolidation or closure.

Wrangle Data to Improve Student Experience and Campus Operations

Universities and colleges are bringing advanced technology to campus interactions and creating more digitally enabled experiences. For example, some schools are implementing “Internet of Things” devices across campus and installing sensors on buildings and access points. These advancements create a plethora of data from disparate sources across campus operations. When schools understand how to harness that data, they gain a goldmine of valuable information, which they can use to improve student experiences, positively impact graduation rates, and determine the optimal allocation of limited resources to maximize return on investment.

Consider The Following Use Cases Highlighting The Use Of Insights From Existing Data:

Provide real-time updates on current wait times or optimal times to visit for on-campus activities—such as treadmills or tutoring slots. Alerts can be provided when workstations are available or are likely to come available at the library.

Use predictive analytics to identify students who may be at risk of missing payments, and take a proactive approach to reaching out and providing support if necessary.

Identify success factors for students participating in specific degree programs and the warning indicators that a student may be starting to fall behind.

Study the “what, where, and why” of non-returning students. As schools increase focus on retention, use of external data sources can identify which non-returning students decided to enroll in other institutions, or not at all. Efforts to understand what is driving those decisions can help an institution identify and address the root causes of retention issues in the battle to retain more students and develop more graduates.

Analyze the operational costs of different buildings to assess drivers in cost models and identify opportunities to invest in preventive maintenance or reduce spend. Employ data visualization tools to identify and communicate those opportunities to constituents.

Seizing valuable opportunities and addressing challenges proactively, before a negative impact hits, lies in the ability to convert data into actionable insights. Armed with the power of predictive analytics and data visualization, leaders are better equipped to manage student progress, gain operational efficiencies, and ultimately increase the odds of success for future generations of students.

Securing the Institution’s Mission

U.S. colleges and universities now operate in an environment where changes abound—from the cost of tuition, to technology and data advancements, to student demographics and student expectations. For many institutions, competition for students is increasing as the pool of prospective students is shrinking. Operating in this landscape is challenging, to be sure. But it also presents an opportunity for finance leaders to manage differently by shrugging off inefficiencies in favor of automated processes and self-service technologies that elevate student experience and engagement and to focus on creating sustainable financial health for both students and the school.

As schools begin operationalizing these strategies, they should consider a partner who provides the latest technology solutions, proven expertise, and accompanying services. Success

in attracting and retaining students through graduation is essential to continue schools’ missions of inspiring and educating students as they pursue their greatest potential.