Historically, mergers and acquisitions (M&A) due diligence has not considered cultural risk a crucial integration factor, and due diligence activities don’t go much further than looking at the leadership and management structure of the target company. The mindset of the past has been that if we understand the leadership of a company, we have a good sense of the company culture. After all, culture starts at the top, right? Further, cultural adjustment was considered a concern that would be addressed when combining the two organizations together during integration. In many acquisitions of the past, the presumption has even been that the acquired employees will just naturally accept and adopt the culture of their new company.

However, the M&A industry has seen a recent, increased focus on culture, and ensuring a good cultural fit during integration has become one of the primary concerns of M&A executives. We are seeing an increase in due diligence activities related to the targets’ culture and a more strategic focus on the people and cultural implications of the deal.

In essence, cultural alignment has become the new M&A focus area everyone is scrambling to master. We all know a company’s culture is important, but when does it need to be considered in the M&A life cycle? Do we need to consider culture when analyzing a deal? Or should we let the integration team worry about that? This article will address these questions, as well as provide M&A deal and integration teams with four keys to effectively evaluate culture and achieve cultural alignment during a merger or acquisition.

“M&A executives say the #1 cause for concern during the integration is achieving a cultural fit. #2 is the seamless integration of operations.”

The Effect of Culture on Business Results

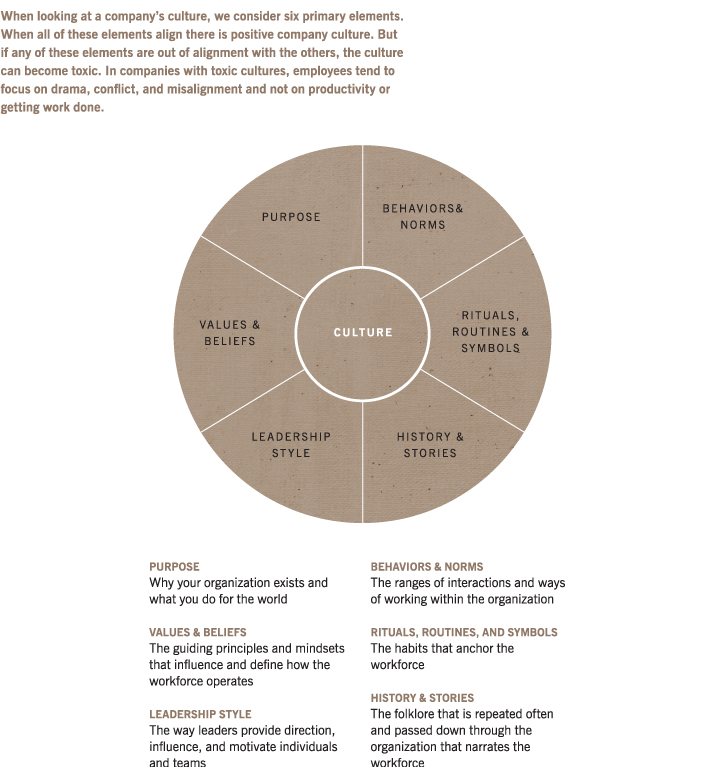

Culture is the set of instinctive mindsets, behaviors, and patterns of habits that shape “the way we do things around here.” Simply put, culture is the way we work and how we operate.

As outlined in the diagram, there are six elements of organizational culture that influence how people work and interact.

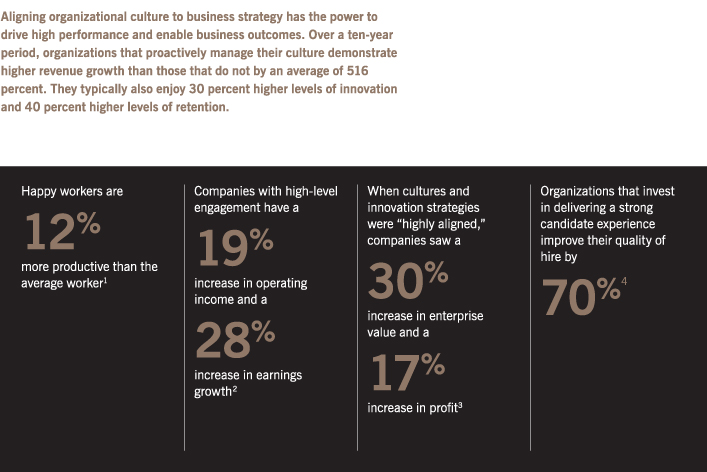

A focus on organizational culture is important because it impacts everything from performance, employee morale, and how customers are treated, to perception in the media and marketplace. Culture influences employee satisfaction and thus employee engagement. Additionally, culture impacts the brand and a company’s ability to attract and retain critical customers, suppliers, and talent. A well-maintained and purposefully built company culture can support positive outcomes of the core elements and strategy of the business.

In contrast, in companies with toxic cultures, employees tend to focus on the drama, conflict, and/or misalignment and not on getting their work done, which ultimately detracts from the business strategy and outcomes. Further, a culture that overemphasizes a specific part of the strategy may lead to unintended consequences. For example, “results at all costs” can create problems such as fraud or lack of compliance, which creates legal, reputational, and financial risk.

In the context of M&A, we now have two or more company cultures that are about to collide into one. Regardless of the deal size, the number of employees being acquired, or the deal type (merger of equals, full absorption, best of breed, etc.), the company culture of the acquirer will change with an M&A event. Each acquisition or merger impacts the culture in some way and to some degree: the investment thesis has concluded that the acquisition or merger will add to, enhance, or provide the ability to leapfrog key capabilities or offerings, all of which will likely impact both organizations in terms of people, process, and technology. In turn, each impact and change has a net resulting impact on the culture.

For example, a change to internal payroll where a workforce is going from weekly to biweekly payouts could be a major change for the employees that would undoubtedly impact how they feel about the company and possibly their ability to fulfill their personal and even professional obligations. Changing the cadence of a paycheck, especially when the frequency decreases, may inhibit an employee’s ability to pay bills or provide for their family. The uncertainty the employee may feel can permeate to on-the-job situations and impact performance. In turn, the poor performance of a team member can lead to lower team morale and decreased team productivity.

For larger deals and mergers of equals, the combining of two cultures can create misalignment of the core elements of culture, and that misalignment can lead to conflict. Once conflict exists, we begin to see leakage and drainage of the deal value if people are distracted and focused on the conflict instead of on their work and productivity. A large part of that conflict is likely that they just don’t know how to move forward or how to get things done effectively. The old ways of working have changed, and that imbalance can create paralysis in the workforce if not recognized and addressed.

For the reasons outlined above, M&A executives must realize that to achieve, and possibly exceed, deal targets for revenue and growth, they must understand the cultural misalignments early and mindfully address them as part of the integration.

1. Document the Company Culture Before Embarking On the Next Deal

More and more companies are starting to include cultural assessments as part of the standard due diligence playbook, especially for larger deals. The cultural assessments allow the acquirer to identify and begin to mitigate early on the misalignments that could create conflict once the deal closes.

To successfully combine one or more cultures during an M&A event, one needs to understand the major differences of the organizations being impacted, which requires a detailed understanding of both company cultures, including existing pain points and non-negotiables. Before embarking on a deal, and especially for highly acquisitive companies, it is prudent to understand and document the current culture to save time later. This will allow for due diligence efforts to be focused on the key differences with the target company and the identification of areas to be addressed.

2. Evaluate the Target Culture During Due Diligence

To uncover the culture of the target company during due diligence, the M&A team should engage in a series of interviews with key contacts that are “under the tent” in addition to requesting and analyzing key documents such as organizational charts, employee census data, employee survey results, attrition metrics, and company policies and procedures. The goal of this diligence is to develop an understanding of the key cultural characteristics of the target and to identify “non-negotiables” that could lead the integration astray. The key considerations that the interviewers should explore would include topics such as:

- Leadership styles

- Compliance history with company policies and procedures

- Technology usage and dependencies

- Performance expectations

- Rules and rituals

- Job architecture (roles, responsibilities, job descriptions)

- Organizational politics

- Decision-making frameworks

- Relationship dynamics

- Employee engagement and life cycle

It can be extremely valuable to engage an M&A integration partner to conduct these initial interviews, as people tend to disclose more information to an uninvested third party.

“Looking beyond operational and financial risk to gain an understanding of the cultural and people implications of the deal will ensure Employee stability and a non-disruptive Customer Experience.”

3. Identify and Address the Misalignments as Part of the Integration Approach and Plan

Once the initial cultural assessment is complete, the M&A deal team will be armed with critical knowledge that should be factored into the go/no-go decision for the deal. Likewise, the M&A integration team will be armed with critical information on the misalignments and “hot buttons” to be addressed and mitigated in the integration strategy and approach. The sooner the integration team is aware of the hot areas to be addressed, the better chance they have to mitigate them and avoid issues later that will ultimately suck value from the deal.

4. Increase the Focus and Importance of Fixing Misalignments When Cultures Clash

Sometimes cultural assessments show that the two cultures are drastically different and may even clash in major areas. When this happens, should the deal be reconsidered? Possibly, but probably not. Even if cultures clash or are drastically different, it’s not necessarily the end of the deal. Two drastically different cultures might even be a good thing to be embraced and celebrated because they have likely gone about capturing and retaining customers and employees in totally different and unique ways.

When cultures are drastically different, it does mean that extra time and effort need to be placed on recognizing and acknowledging the differences pre-close and then addressing those differences in the new operating model that’s being built during the integration phase. When designing the target operating model, which in turn feeds the detailed integration workplans, it is important to ensure that “hotspots” and misalignments are addressed through shifts and tweaks to processes, expectations, and behaviors. The shifts and tweaks could come in the form of new technologies, new processes and/or policies, the addition or formation of a new team, or the promotion or introduction of new leadership. Whatever the changes are, they should be specific, intentional, and purposefully planned.

When this scenario occurs, it is important to ensure that the major components of the operating model being built are aligned to and reinforce the desired cultural attributes of the new organization. Specifically, all employee touchpoints (e.g., onboarding, training, performance management, employee engagement) across all work streams should be mindfully designed to align with and reinforce the new culture.

Mergers and acquisitions, regardless of deal size or type, affect the company culture for both the target and acquiring companies. When done thoughtfully, an M&A event can enhance an already positive company culture or fix a toxic company culture. But when culture is ignored or addressed haphazardly, the net result is almost always negative, and it can be nearly impossible to achieve the intended outcomes and value of the deal. To increase probabilities of success and help meet and even exceed expectations, M&A executives should place a high degree of importance on understanding and addressing culture. Conducting a cultural assessment during due diligence and then validating those results as the deal closes — and throughout the integration — will provide the integration team with the data and information needed to address the misalignments and capitalize on the similarities that exist between the two companies mindfully and strategically.