Yet, there is considerable dispute over what to do about it. To make matters worse, the very subject is tangled in a Gordian knot of political winners and losers, social ideology and economics. Albert Einstein famously said, “We cannot solve our problems with the same thinking we used when we created them.” Based on that insight, how will we think differently to solve this seemingly intractable problem of our time?

While the highly polarized political boxing match enters another round in Washington, D.C. it is useful to create constructive conversation based on what is most factual, namely the status quo of the health economy’s financial well-being. Placing emphasis there focuses the debate on the root problems causing economic distress, and in the spirit of objectivity, keeps the dialogue as neutral as possible. Therefore, instead of opining about policy, laws, or who is to blame for the system’s maladies, it’s more productive to assess the American health economy’s financial system against a set of tenets that generally describe healthy financial systems, regardless of industry or country. Throughout the discussion, a few suggestions for unwinding health care’s Gordian knot are offered. Yet, it’s important to evaluate the context of the American health economy’s financial system with the tenets proposed before identifying how you and your organization may prescribe a remedy.

What are health economies and financial systems anyway?

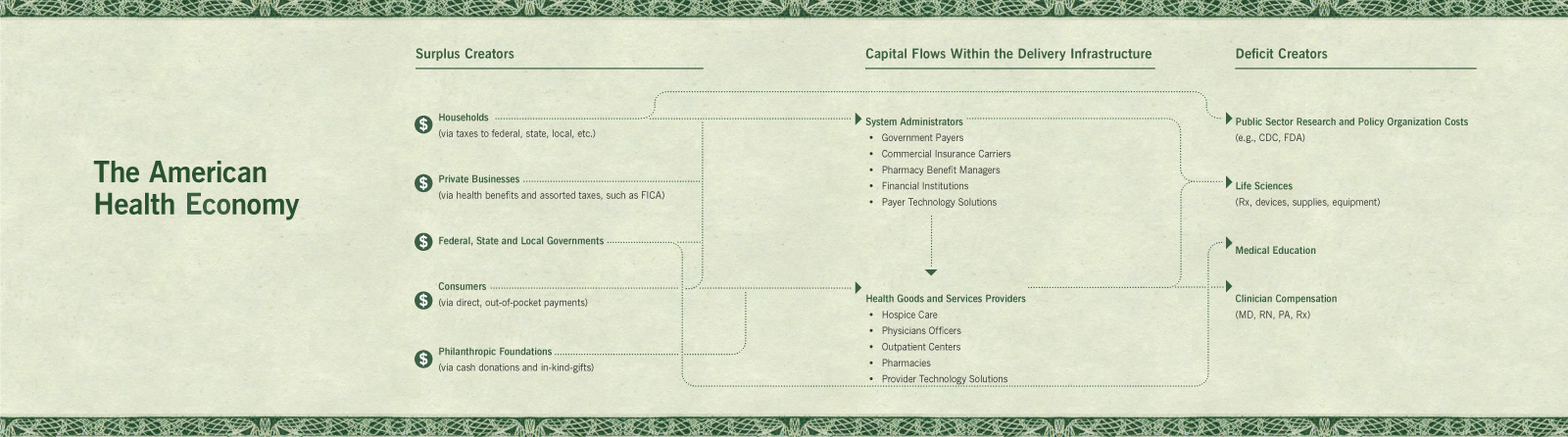

A health economy, or sometimes called health system, is the organization of people, institutions, and resources to deliver health care services to meet the health needs of target populations. In other words, it is who, how, and to what extent health-related support is delivered to a population. Using that premise, each health economy has an underlying financial system, inclusive of the institutions, capital flows and regulations governing the transfer of funds. The International Monetary Fund (IMF) defines a financial system as “consisting of institutional units and markets that interact … for the purpose of mobilizing funds for investment, and providing facilities, including payment systems, for the financing of commercial activity.” At its core, any financial system enables economic activity to occur by facilitating the transfer of funds from individuals or entities that create financial surplus to those that consume capital to those that ultimately create financial deficits. The network connecting these individuals and entities constitutes a health economy’s financial system. The resultant web of stakeholders, institutions and financial capital flows illustrates a simplified schematic of the American health economy.

What makes for a simplified diagram is much more complex in reality. Health economies and their financial underpinnings are multidimensional and multigenerational. They also cross geographies and contain a wide range of stakeholders, ranging from the federal government to the corner drug store. On a national scale, the federal government orchestrates the intergenerational tax-funded Medicare program for senior citizens and enforces laws regulating commerce across state lines. It also enforces consumer protections and, most recently, mandates that all citizens must hold a minimum form of insurance coverage. At the state level, departments administer the Medicaid program and control insurance premium fluctuations. Cities create their own health microcosms through localized regulation (e.g., NYC’s soda size limitation) while employers create firm-specific economics through employee health benefit programs. Analyzing these dimensions across 317M citizens of arguably the world’s most diverse populace, it is easy to see how the health economy and its financials became a Gordian knot of problems.

So what is the status quo of the U.S. health financial system?

Three elements typically describe the dynamics of a health economy; therefore, studying them helps to put context around the issues facing the American system.

1. Relative Economic Size:

Measured nominally, the American health “GDP” is larger than all other complete economies on Earth, except those of Germany, Japan, China, and the U.S., of course. America’s health financial system channeled roughly $2.7T in 2011 out of a $72.7T gross world product (GWP). That sum is 3.8% of the GWP in 2011 and 17.9% of U.S. GDP in nominal USD. If we could have cut 10%, it would have saved roughly the GDP of the seventh most populous country on Earth, Nigeria. To put things in perspective, the value of health goods and services on a per-citizen basis is approximately $8,500 in the U.S., while the value of all Nigerian goods and services is $1,500 per person. Any way one calculates it, the numbers are staggering.

2. Approach to Financing and Delivery:

In most developed nations, health care financing and delivery is government sponsored, privatized (market-driven), or a blend. American health care financing is a private-public hybrid with 55% of funds coming from the private sector and 45% from the government. On the delivery side, about 80% of facilities are private with a relatively small amount of care rendered in government owned and operated hospitals (CITE). In fact, about only 20% of hospitals are government owned and account for only 14% of stays (as of 2008). Of the remaining 80%, the private hospitals are split

three-fourths non-profit and one-fourth for-profit.

3. Regulatory Environment:

There is significant legal control over the health care sector. Regulated through various agencies, a cascade of federal and state laws is on the books designed to protect consumers (e.g., Health Insurance Portability and Accountability Act) and govern the health market place (e.g., Patient Protection and Affordable Care Act). The Department of Health and Human Services (HHS) oversees: Centers for Medicare and Medicaid (CMS), Agency for Healthcare Research and Quality (AHRQ), Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA).

The tenets of a healthy financial system, applied to America’s health economy

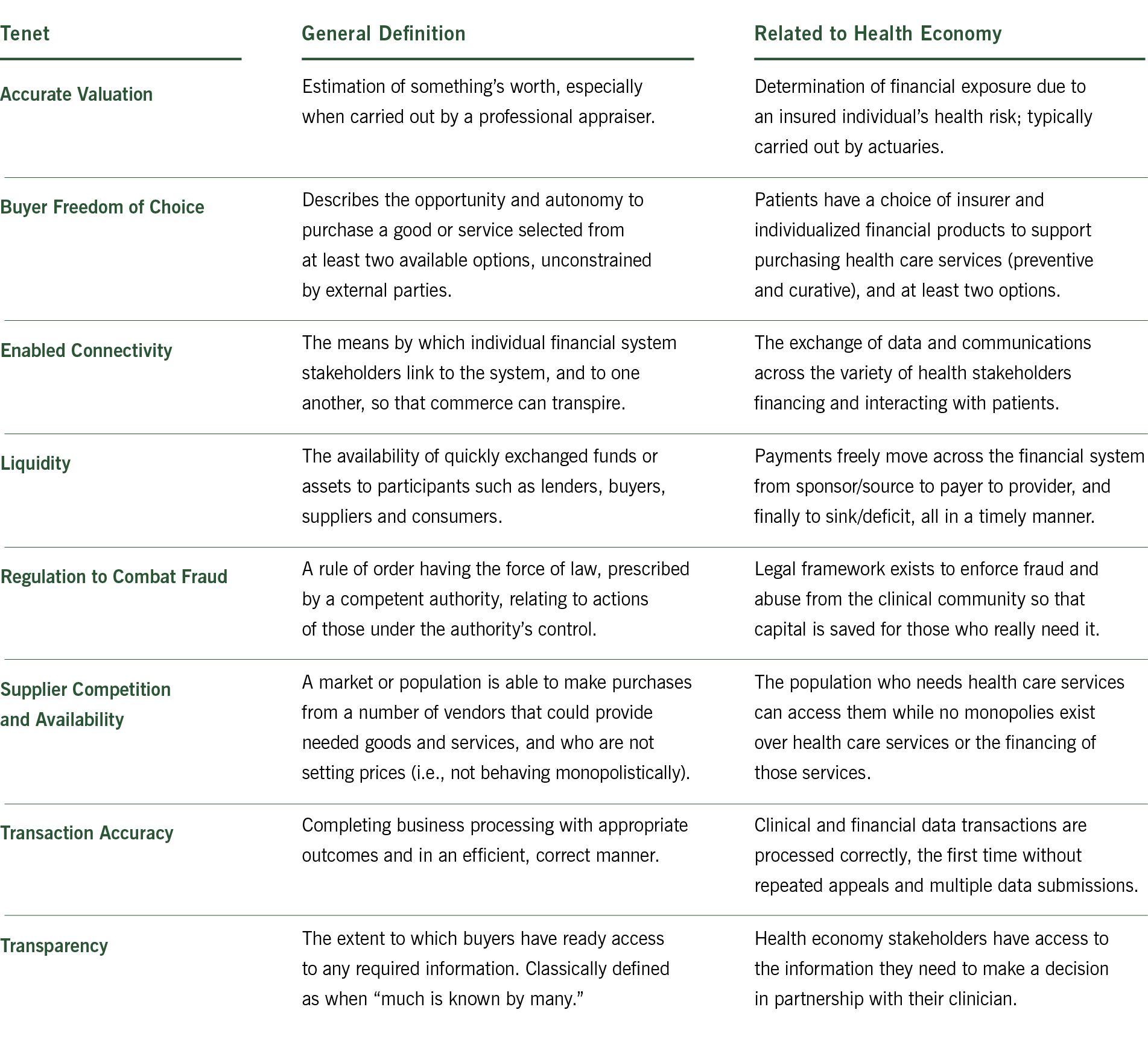

There are tenets that describe healthy financial systems, regardless of industry or country. If operating well, a financial system with these qualities tends to create relatively more efficient and effective financial outcomes than unhealthy ones. Applying them to America’s health economy is a practical way to lower transaction costs, drive information transparency, mitigate overspending and induce fair prices reflective of marginal cost (i.e., the cost to produce an additional unit of health care). Each tenet is generally defined and then related to the health economy.

Mobilizing near-term remedies for longer term financial health

When designing, operating, and measuring their health-related organizations, policy makers, business leaders, and entrepreneurs may draw upon these tenets to drive qualities of healthy financial systems in their decision-making heuristics. In the accompanying illustration, each tenet is qualitatively evaluated against a “well-being” scale, ranging from well to catastrophic. The discussion below summarizes challenges as they relate to each tenet and offers a perspective for alleviating that issue.

1. Accurate Valuation:

It is difficult to accurately value and forecast health risk with limited, disjointed data residing in various databases. While recent reforms eliminated individual medical underwriting, it is suggested that insurers develop a common health risk scoring system that calculates each person’s risk. The standard “FICO-style” system should suggest behavioral-based incentives for each person to improve his or hers with exceptions only in extreme situations. Risk-bearing entities should use this approach universally.

2. Buyer Freedom of Choice:

Historically selected by their employers, most consumers do not have the depth of knowledge or experience when purchasing a health insurance product that fits their individual needs or situation. Therefore, policymakers should consider eliminating the largest federal tax expenditure, which is for employer-sponsored health care. In conjunction with next-generation health benefit exchanges, this approach will accelerate the move to individual health insurance, generating real consumerism behaviors. Further, when evaluating care decisions, patients may not be in a normal mental state, nor do they often have deep medical knowledge to make informed decisions or consider a second opinion. Hence, it should be mandated that patients preselect a primary care team (or select one for them if they do not make a choice) and provide care coordination teams to those patients who require referral outside of that team to mitigate the problems occurring when patients experience fragmented care, such as unnecessary readmissions or avoidable complications.

3. Enabled Connectivity:

Financial systems are disjointed within individual health providers and insurers. Consumers have difficulty unifying information to make decisions, as do those same hospitals and insurers providing goods and services. Therefore, it is useful to design a universal communication network to allow patients, clinicians, hospitals, and insurers to exchange data and provide simplified care instructions unencumbered by legacy or organizational silos. Also, stakeholders should continue to propagate the use of information technology across geographies, regardless of whether

it creates short-term cost rather than benefit.

4. Liquidity:

There is a longstanding liquidity crunch between health insurers and care providers as they dispute charges and amounts paid for services provided to patients. Disputes can last years and accounts payable and receivable can both suffer significant lag as a result. To change this situation, stakeholders should continue to support insurer-provider alignment by investing in simplified payer-to-provider financial protocols with easier-to-process contracts. This will provide incentives for stakeholders to collaborate and alleviate backlogs. It should not take weeks to get prices or for invoices to be processed.

5. Regulation to combat fraud:

With big money comes big crime. Imposter clinicians have scored millions while even some legitimate providers inadvertently over bill or practice defensive medicine solely for their financial benefit. As data is organized and digitized, the industry must continue to implement ironclad security and data protection measures that support new analytical approaches to recoup fraudulent sums for the consumer that would otherwise be misused.

6. Supplier Competition and Availability:

There is market power consolidated with a few very large national health insurers with little direct competition except in the burgeoning exchange market. As insurers and care-delivery institutions

are increasingly merging or acquiring one another, the industry must evolve to an integrated Amazon.com-like shopping experience for those evaluating what financial products to purchase for their health care financing needs. Doing so lowers barriers to preventive services and appropriate care. Even if providers are part of the same entity, developing ways to introduce meaningful competition among care teams based on outcomes, not each encounter or process, will change the status quo.

7. Transaction Accuracy:

Health care claims can take months to accurately process against contracts, negotiations, appeals, and benefit structures. Therefore, stakeholders should develop fewer standards for transmitting clinical and financial data similar to the interoperable standards in the financial services and banking industry. At the same time, patients whose financial invoices are not processed timely should be liberated of financial liability, which will incent insurers and hospitals to improve accuracy.

8. Transparency:

It is well documented that doctors and hospitals cannot quote a price until a service is given because a diagnosis must be made, care decision rendered, and procedure initiated before any specific coding can be done. Therefore, improvements to information presentation for patients and their health “inner circle” must be created, potentially by building clear lines of sight into cost and information for sharing. Stakeholders should also develop pre-negotiated price estimate ranges so that patients understand the financial stakes and what financing mechanisms

they have at their disposal to pay.

Conclusion

Taking what we described about the American health economy’s sheer size, public-private hybrid model and already strict legal environment, a systemic change to the way its financial system runs must occur. Because financial capacity plays a major role in providing health care, it should be the basis upon which non-clinical evaluation begins. Based on this analysis, some recent reforms were a step in the right direction (e.g., adding support for connectivity, buyer freedom of insurer choice, and liquidity) while others may benefit from additional reform redirection (legal regulation, accurate valuation, and transparency). It’s important to think about the health of the American health economy from the perspective offered above and to draw upon its premise when determining how your organization works to renovate our nation’s chronically ill health economy.