Other developments have added to the enormous strain on an increasingly fragile global order. From ongoing supply chain issues to persistent inflation, territorial and maritime disputes, trade restrictions, political instability, protectionism, and war- and climate change-fueled disasters, there are plenty of significant, disruptive forces jockeying to become the next major crisis for businesses. International businesses have felt the impacts of the increased global tensions and are racing to respond to protect their operations, markets, assets, and employees, and defend their reputations.

Still, the playbook for geopolitical risk management is largely unchanged in the face of mounting pressures that threaten to cleave the world into siloed great-power blocs.6 The focus has been on building resiliency in the business — operations, organization, technology, financials, and reputation — to “withstand” mounting pressures. In other words, manage the risk but let business continue as usual otherwise. In the face of the short-term, one-off, and localized disruptions in global relations the world has experienced over the past few decades, this approach has been effective.

The traditional approach to geopolitical risk assumes that globalism is the bedrock of the international system. So, business leaders must ask, can the traditional risk approach continue to work in a world where crises are increasing in severity and frequency? Could recent crises have been further mitigated with a different approach to geopolitical risk management? And what will happen to businesses if globalism truly breaks down?

In this article, we explore the challenges to globalism, how they are likely to impact the international business environment, which businesses are most likely to be impacted, and what changes leaders should begin making today to business operations, investments, and strategies to thrive in this new reality of declining globalism and increased conflict.

A View on the Future of Globalism

In the U.S. National Intelligence Council’s Global Trends 2040 report, the authors lay out humanity’s challenges over the next two decades, including challenges that will impact governments and businesses alike:

“The rivalry between the United States and China is likely to set the broad parameters for the geo- political environment during the coming decades, forcing starker choices on other actors…increased competition over international rules and norms, together with untested technological military advancements, is likely to undermine global multilateralism.”

In the report, the authors describe five potential scenarios for 2040. The report describes the first three as “futures in which international challenges become incrementally more severe,” whereas the other two scenarios “depict more radical change [arising] from particularly severe global discontinuities, and both defy assumptions about the global system.” In these cases, either “globalism has broken down” or the world sees “revolutionary change on the heels of devastating global environmental crises.”

While these are merely some of the potential scenarios that humanity faces over the coming decades, it is sobering to note that none of those laid out in the report envision globalism continuing and expanding along its historical trajectory. This implies that continued reliance on and assumptions about globalism are risky propositions.

We already see globalism beginning to crack. While businesses at the forefront of geopolitical risk management have managed to not just survive but profit from these cracks,7 the full extent of other challenges, such as Taiwan’s status, new U.S. protectionist trade policies, and the global rise of nationalism, have not fully played out. What will happen to global businesses that rely on Taiwanese microchips if China decides to invade Taiwan in the coming years as a reaction to U.S. export bans on chip technology? What will relations look like between the EU and U.S. as the full effect of the Inflation Reduction Act comes into force and nationalist governments continue to rise in Europe? How will the world look if the situation in Ukraine continues to escalate, including the possible use of a nuclear device?

Business leaders must ask, can the traditional risk approach continue to work in a world where crises are increasing in severity and frequency?

The likely path has been laid out based on what happened in Russia in March 2022. In this case, traditional approaches to geopolitical risk management failed. Western businesses in Russia were, at best, subject to social and government pressure campaigns to take a stance and, at worst, impacted by the onset of rapid, crippling sanctions with no clear end in sight. In many cases, business resilience failed in the face of sanctions. Cut off completely and indefinitely from their operations in the conflict countries, businesses were forced to suffer significant losses: loss of revenue due to market and trade restrictions; seizures of facilities, equipment, and intellectual property; loss of valuable personnel; and potential long-term declines in innovation.8

While it is unclear if these Western sanctions have had any meaningful impact on Russia’s war effort, two things are clear. First, Western governments continue to believe in the power of sanctions, which means they will likely continue to use this approach in future conflicts. They will establish long-term sanctions, embargoes, travel bans, and other mandates, to inflict maximum pain and consequences. Businesses will simply be caught in the middle. Second, even if governments abandon sanctions in future conflicts, increasing isolationist and nationalist tendencies and declines in globalism mean that sanctions and other similar trade restrictions will become the norm, impacting governments even outside of armed conflicts.

Who Is at Risk?

In the 1970s and 1980s, businesses moved manufacturing in droves to low-cost and low-regulation countries regardless of alignment of values or political systems. Low-cost wages far offset the increases in shipping costs of moving goods to end markets. As these markets developed middle classes, businesses looked to open technology centers, development centers, and Research and Development (R&D) in low-cost countries. In many cases, access to the rapidly growing markets was predicated on technology sharing or technology partnerships with the host government’s military and domestic agencies. The combination drove international businesses to sell in foreign markets, and to physically exist, invest in, and support these markets and governments. This, however, came with a host of downsides. Quality issues, domestic worker discontent, theft of technology, and the rise of nationalized competitors have all been a direct result.

For businesses, the associated cost reductions and access to growing markets were enough to justify the tradeoff. This also exposed these businesses to geopolitical risk in a more significant way than businesses simply selling into foreign markets. That is why businesses now face increased exposure to the growing international discord and the attendant declines in globalism, and it is now incumbent on international business leaders to assess their own exposures. To understand the risk, business leaders must first map this international exposure and then determine if the exposure constitutes a genuine and manageable risk. What follows is our suggested framework for evaluating your risk below and a strategy for managing the risk.

How to Survive

Assess your business’s footprint in the context of geopolitical conflict and anticipated geopolitical axes. The three primary areas you should assess are your global operations footprint, global technology footprint, and global sales footprint. Bucket the countries where you have sales, operations, and R&D/solution centers into three buckets:

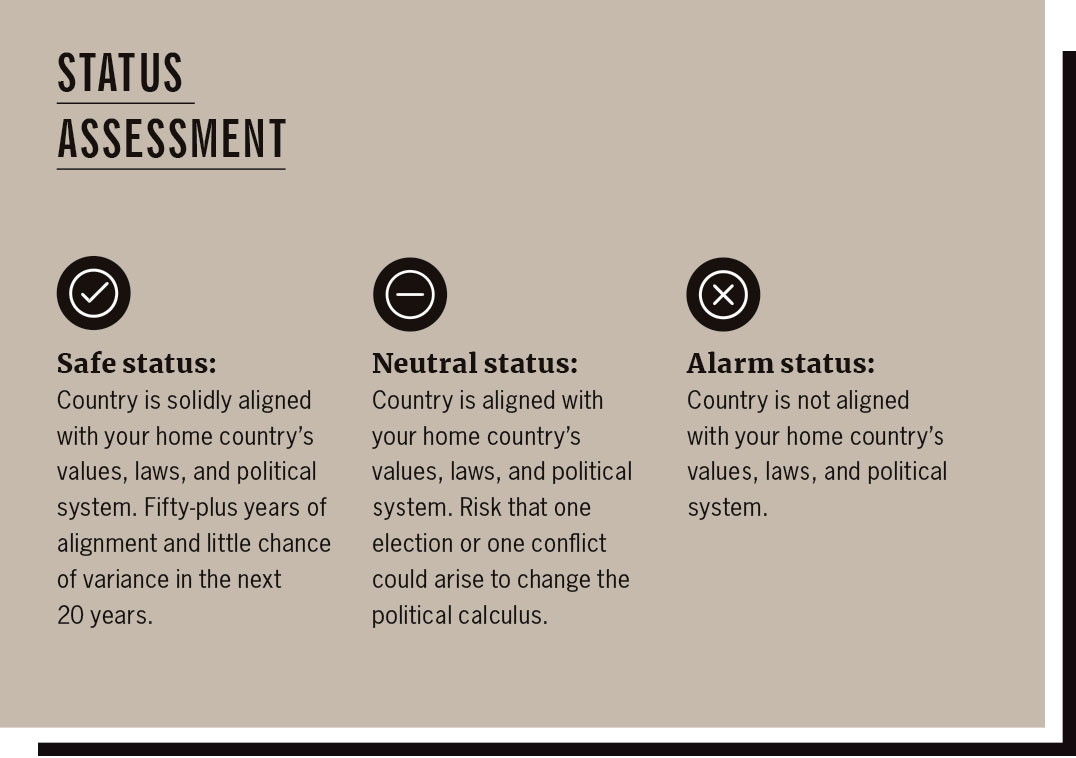

Status Assessment

Safe status:

Country is solidly aligned with your home country’s values, laws, and political system. Fifty-plus years of alignment and little chance of variance in the next 20 years.

Neutral status:

Country is aligned with your home country’s values, laws, and political system. Risk that one election or one conflict could arise to change the political calculus.

Alarm status:

Country is not aligned with your home country’s values, laws, and political system.

We recommend that companies plan to de-risk their exposure to Alarm Status countries immediately. We further recommend that for Neutral Status countries, companies should develop a monitoring mechanism to watch developments. This does not have to be complicated. Engage your country’s state department and figure out how to get monthly, quarterly, and annual updates. Assign a senior executive to be the “monitor-in-chief” for each country and give them a travel budget to visit the countries on a regular basis based upon the importance of the country to your business.

For Safe Status countries, expect them to offer incentives for moving business there. Learn how they work internally and see if you can find ways to get your “shifts” paid for by others. In the U.S., for example, look at states such as Texas, Arizona, and Georgia, among others, to see what incentives they would have for onshoring manufacturing or technology jobs.

Regardless of your specific mix of exposure and risk, we recommended that any business operating with a significant international footprint create a robust risk department. The department should be led by an officer or other senior executive and serve in a coordinating role with in-country risk monitors. The department should further be tasked with monitoring and mitigating all forms of risk to the business, including geopolitical, and coordinate other actions in response to crises. Going forward, this level of risk management will be table stakes for any international business. As we walk through operations, technology, and sales below, you will see a common theme.

Global Operations Footprint

The decline of globalism means that geopolitics has surfaced as a binary risk factor for business operations. It is not simply that geopolitical tensions will reduce trade amongst adversaries, but it may eliminate it altogether, as in the case of Russia, where there is now virtually no trade between Russia and Western countries. This can happen very quickly, so it is imperative to de-risk in Alarm Status countries — that is, begin unwinding or completely cease operations — before a geopolitical event strikes. Plan to move operations out of Alarm Status countries in the near term, depending on the degree of difficulty. For heavy manufacturing, it could be unrealistic to move it within 10 years. New investment, however, can stop immediately, and plans can be made to close it once the equipment deteriorates or is depreciated.

Global Technology Footprint

Increasingly, technology is key to competitiveness and financial health. Protect your intellectual property. Not just legally, but through technical, physical, and process barriers, restricted hiring, and careful partnering. If you are operating in an Alarm Status country, consider that your intellectual property may be viewed as a target for espionage and act accordingly. Since governments are well equipped to transfer technology and intellectual property by force, you should immediately begin to move R&D and IT centers and systems from Alarm Status countries to Neutral or Safe countries and stop coordinating tech policy with these unaligned governments as soon as possible.

Global Sales Footprint

As you consider sales and revenue in Alarm State and Neutral State countries, forecast what your P&L and balance sheet would look like if your sales or cash in those countries were frozen or taken. What does that do to your business? Depending on the degree of impact, make moves to lessen the burden by learning to run the in-country business with less cash and other assets (e.g., increase inventory turn). Specifically, we do not recommend discontinuing sales in these countries, but we do recommend making changes to ensure that in the event of a crisis, you do not lose cash for sales already won.

Your People

Last, but not least important, is your people. There are employees in these countries who have been loyal, profit-generating teammates with families and careers. What is your company’s culture and what does it say about how you should treat these teammates? Have a plan for how your company will react in different circumstances and look to relocate employees from Alarm Status countries if you can. In the wake of COVID-19, virtual and hybrid work are options for many employees. While there are potential downsides, special consideration should be made to accommodate employees who may find themselves in such work locations. How you react to events as they unfold and how you treat these employees is important not only because it is the right thing to do, but also because it will impact your brand, other employees’ productivity, and your image globally with all your stakeholders.

By reshoring jobs from Neutral and all Alarm Status countries, companies have an opportunity to rewrite the narrative, improve the economies of the areas in which they operate domestically, and get a reputational and political win within their home countries.

“”

How to Thrive

Much of the discussion to this point has been on how to identify and reduce risk due to geopolitical conflict and declining globalism. Beyond surviving, there may be opportunities to thrive as the world undergoes the predicted transition to a new international system. We discuss several possibilities below.

Reducing Costs

While the original impetus for moving operations in the ‘70s and ‘80s was access to low-wage labor, the calculus has changed over the last two decades. Wages in many low-cost countries have skyrocketed and no longer offset the increased logistics costs. Shipping costs have also increased, and carbon footprint has become an important consideration. Meanwhile, robotics and rapid prototyping have reduced onshore manufacturing costs, and the speed of innovation has increased as a competitive factor. As a result, the initial cost calculus may no longer favor the Alarm Status countries, meaning that reshoring from one of these countries may be a zero-sum decision. More likely, reshoring may be a win-win for reducing geopolitical risk and improving your business’s operating costs, but much of the benefit is likely to go to first movers, so do not wait to begin planning your move.

Reputation and Politics

Offshoring predictably became a public relations nightmare as more domestic workers began to lose their jobs to lower-wage workers in other countries. While it enabled much of the macroeconomic success the U.S. enjoyed in the decades that followed, the impacts on individuals and communities were quite negative. By reshoring jobs from Neutral and all Alarm Status countries, companies have an opportunity to rewrite the narrative, improve the economies of the areas in which they operate domestically, and get a reputational and political win within their home countries. Again, businesses at the leading edge and making the biggest moves stand to get the most benefit.

Partnerships

As you move your R&D and solution centers out of Alarm Status countries, consider moving them not only to your home country, but to other Safe Status countries. Presumably, one of the reasons you opened R&D in remote locations was for diversity of thought and creativity. You do not have to lose that as you reduce your geographic risk. Open in other countries with less risk or create partnerships with other industry players so that you continue to benefit from that diversity of thought.

Summary

Businesses should begin to understand their specific exposure to geopolitical and international business risks and begin addressing the most urgent and impactful of these risks now. They should also put plans and strategies into place that incorporate risk management into the culture and foundations of their enterprise. While some of the changes we recommend may come with short-term pain, wise leaders will understand that adopting these changes now will lead to a business that is more resilient to unfolding geopolitical forces, ready to meet future challenges, and well-positioned to thrive in the new world.

Sources:

- https://www.npr.org/2022/03/02/1083999375/companies-exodus-russia-exxon-bp-apple-wework

- https://www.nytimes.com/article/russia-invasion-companies.html

- https://news.harvard.edu/gazette/story/2022/04/how-war-in-ukraine-is-reshaping-global-order/

- https://www.reuters.com/business/russias-war-ukraine-may-fundamentally-alter-global-economic-political-order-imf-2022-03-16/

- https://blogs.worldbank.org/developmenttalk/how-war-ukraine-reshaping-world-trade-and-investment

- https://www.dni.gov/files/ODNI/documents/assessments/GlobalTrends_2040.pdf

- https://apnews.com/article/biden-business-prices-government-and-politics-ba71f46a47c2be5a2ffd58a258796260

- https://hbsp.harvard.edu/product/H06WOT-PDF-ENG?itemFindingMethod=IDP+Recommendation