Suppose you’re trying to get to work in the morning. An office building is your destination. But before you get to the building, you travel halfway there, celebrate the achievement, then travel another half, celebrate the achievement, and so on. Would you ever get to work? This notion requires you to drive to an infinite number of halfway points before reaching work, which Greek philosopher Zeno of Elea (ca. 490–430 B.C.) describes as an impossibility. Imagine the frustration!

Apply this same principle to corporations. If a series of halfway steps means you’ll never reach your destination, why do corporate managers recursively focus on short-term results at the expense of achieving the mission and vision set out by leaders and boards? This phenomenon, referred to as short-termism, has been the Achilles heel of corporations since the 1970s. Simply put, short-termism refers to the excessive and obsessive focus on short-term results — such as quarterly earnings, at the expense of long-term interests — which we translate as achieving the mission, vision, and purpose of the firm’s existence. Despite recent regulatory changes attempting to curb short-termism, firm/manager myopia continues to drive unethical and illegal behavior to seemingly achieve near-term goals. The impact to all stakeholders can be catastrophic, as illustrated by the following examples.

Tesco

An investigation found that British retail giant Tesco was incorrectly expediting revenue recognition and deferring costs to inflate profits to the tune of more than $400 million. Because of its focus on short-term profit, Tesco misled stakeholders and shareholders, causing a disastrous hit to the company’s reputation and a loss in market share.

Groupon

Groupon, an online local commerce marketplace that connects merchants to consumers by offering goods and services at a discount, went public in late 2011. Shortly after the IPO resulted in big paydays for a few, material weaknesses in its internal and financial governance were revealed. Although Groupon was not required to certify internal controls before going public, not doing so was ethically questionable. After a strong initial IPO, the lack of transparency caused a significant decline in share price over the course of the year following Groupon’s admission of the accounting irregularities, resulting in major losses for many.

Olympus

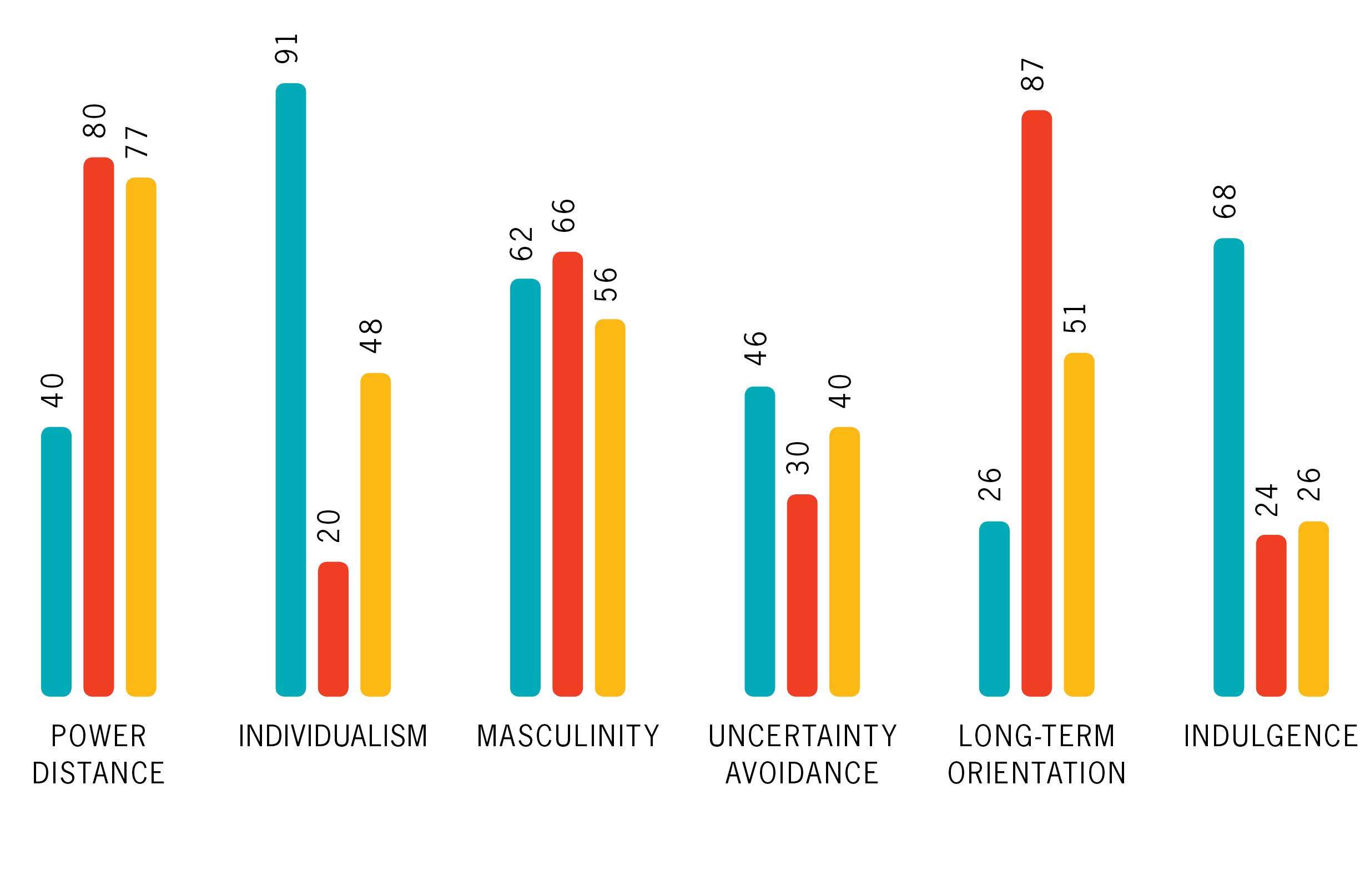

In 2011, Olympus Corporation, a Japanese company involved in a variety of businesses including medical, life science, industrial, and imaging, admitted to $1.7 billion in accounting fraud. The company falsified investments and overstated revenues over a decade to hide its losses. The fraudulent accounting practices resulted in lawsuits, convictions, and large fines. According to the Hofstede Centre, Japan has a high long-term cultural orientation index — an 88 compared to a 26 for the United States (on a scale of 100). Despite this orientation, it appears global connectedness and market pressures drove short-term-focused actions in the long-term-oriented culture.

Short-termism is a complex and challenging problem to solve. We attempt to provide a few thought-provoking, pragmatic solutions — that can initiate change — after a detailed exploration of the systemic and firm/manager behaviors that continue to give life to chasing short-term results.

Evidence of Short-Termism

Apart from these recent examples, how do we know short-termism still exists? The continued focus on and bias for short-termism manifests itself in the following representative ways:

Investment Choices of Firms: A 2005 survey of executives at large U.S. public firms corroborates the notion of short-termism — almost half of managers reveal they would reject a positive net present value project if taking the project meant missing analysts’ earnings forecasts. Accordingly, to show favorable quarterly profits, firms and/or managers tend to forego or minimize investments in R&D and intangibles. This notion is especially true for public firms in the United States, inhibiting U.S. GDP growth by approximately 0.1 percent a year, according to researchers from Stanford.

short-term·ism

/SHôrt’trmizm/

noun

concentration on short-term projects or objectives for immediate profit at the expense of long-term security.

R&D and intangibles spending is less favorable because U.S. firms must immediately subtract most R&D and intangibles expenses from profits (as opposed to amortizing them over a period of time) in order to comply with Generally Accepted Accounting Principles (GAAP). As a consequence, these investments become the first on the proverbial “chopping block.” Perceived to be one of the biggest R&D spenders globally, the U.S. ranks 11th in the R&D category, according to Bloomberg. The top five countries, based on R&D spending, are South Korea, Israel, Finland, Sweden, and Japan. If R&D and intangibles spending fails to deliver immediate, short-term results, firms and/or managers are willing to sacrifice some long-term value to deliver higher profit in the short-term. This ultimately creates a vicious cycle of a quarterly focus at the expense of developing capabilities or investing in intangibles that enable tangible results, regardless of their timing.

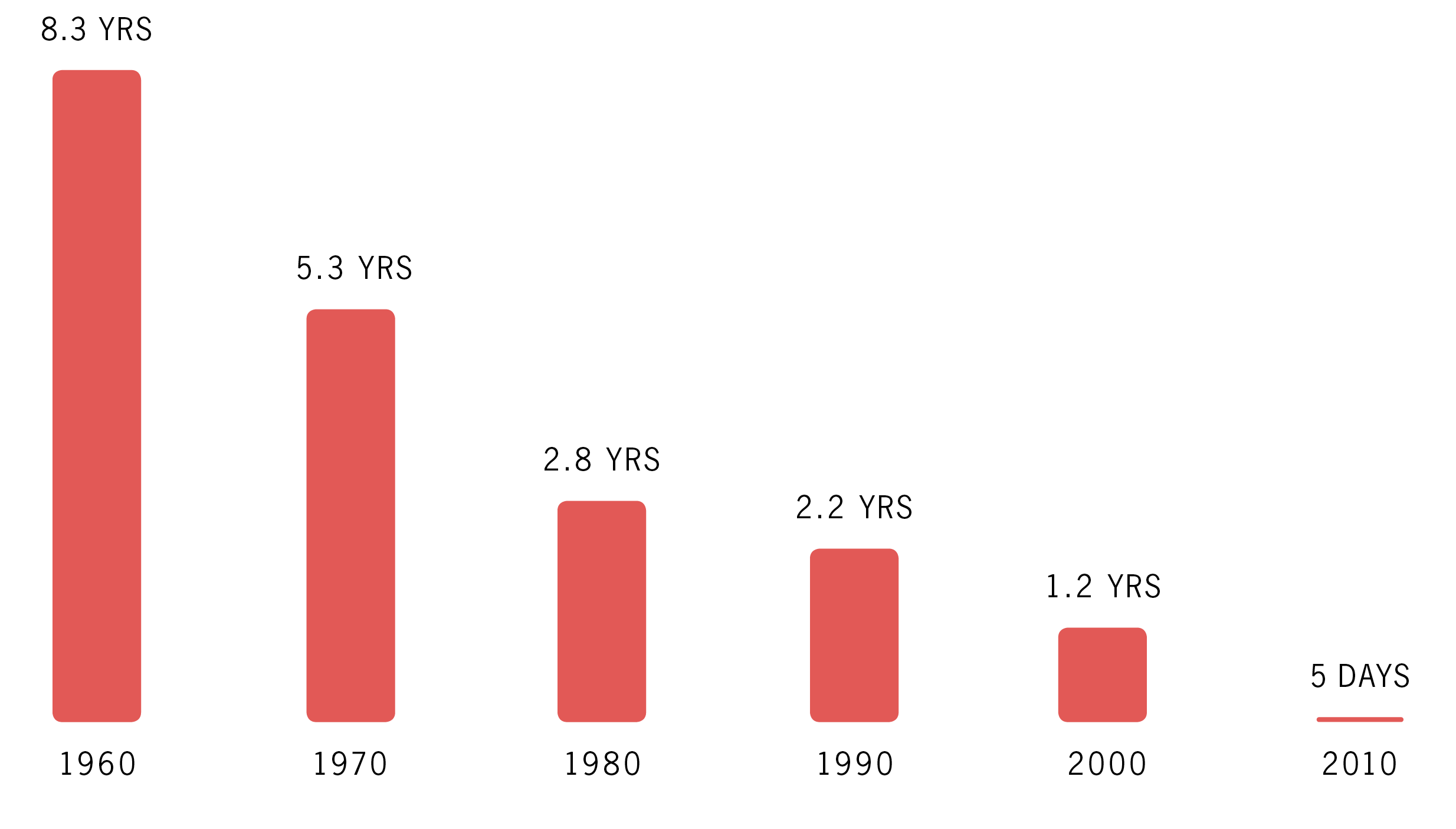

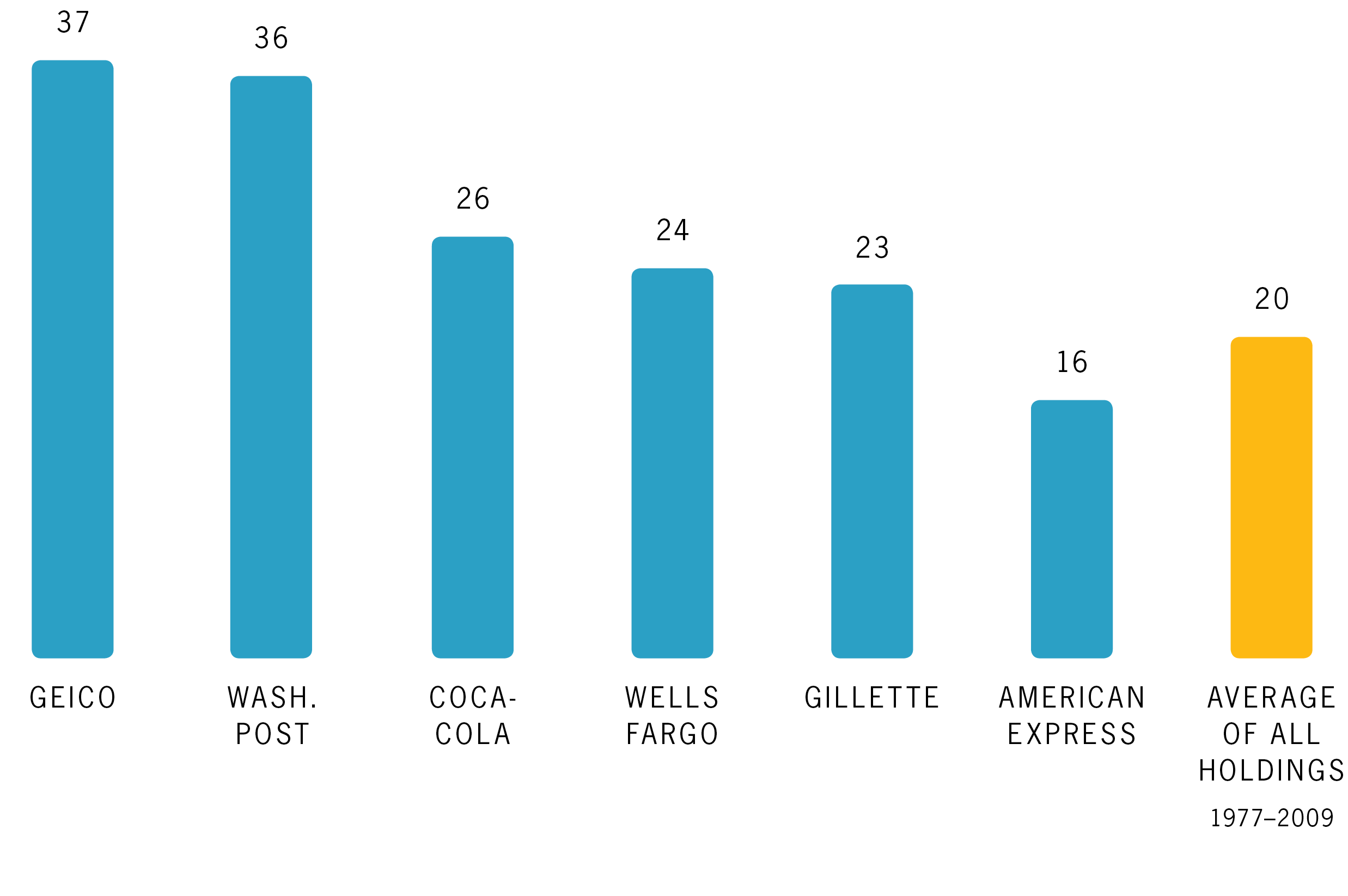

Average Stock Holding Periods and Ownership: According to data from LPL Financial, the average holding period of stock has fallen from eight years, in the 1960s, to approximately five days — nearly a 99.83 percent decline. Our hypothesis is that this decline in the average stock holding period has been and continues to be caused by the rise of institutional investors — hedge funds and private equity firms — pressuring firms and managers to deliver short-term results. In addition, the proliferation of hyper trading or high-frequency trading, where stocks are bought and sold in seconds or even milliseconds, further brings the average holding period down. The likes of Warren Buffett, whose Berkshire Hathaway holds common stock investments an average of 20 years, are few and far between. You’re more likely to see “renters than owners” in capital markets. Incidentally, some of Berkshire Hathaway’s biggest and most prominent holdings also are less likely, if at all, to provide earnings guidance, discussed as a contributing factor to short-termism.

CEO Compensation: From our perspective, capital markets and firm boards also signal impatience for results through CEO compensation structures. Numerous academic and private sector studies show that CEO compensation structures both indicate and drive short-term thinking. Although stock options are being replaced by restricted stock, they still make up approximately 31 percent of compensation packages (in addition to a mix of salary, perks, and bonuses), according to a 2013 analysis by James F. Reda & Associates. Options are intended to be a mechanism to reward performance and retain executives, but academic research by The Wharton School of the University of Pennsylvania highlights the negative consequences, especially in the year prior to their vesting periods. The research shows that when options were about to vest, firms were more likely to meet or narrowly beat analysts’ earnings forecasts. Additionally, according to research by Wharton finance professor Alex Edmans and two colleagues, in this same period CEOs tended to cut investments in R&D, advertising, and capital expenditures in order to pump up earnings.

Drivers of Short-Termism

Underpinning the aforementioned data points are strong drivers that motivate short-term thinking. There are four key drivers:

Shareholder Value (Friedman) vs. Stakeholder Value (Freeman): Prior to 1970, firms understood and fixated on the philosophy that their responsibility was to create value for all stakeholders. Borrowing from authors Sisodia, Sheth, and Wolfe in the book, “Firms of Endearment – How World-Class Companies Profit from Passion and Purpose,” we understand and define stakeholders in this context as society, partners, investors, customers, and employees (SPICE). Undermining this notion, in 1970, Milton Friedman indicated that firms had lost their way by addressing the needs of multiple stakeholders. He proposed a single priority for firms: shareholder value.

How long do Americans hold stocks?

Firms and/or managers in global economies have translated this to mean an exclusive focus on delivering short-term profits to shareholders — intentionally or unintentionally — at the expense of stakeholder interests. However, creating value for shareholders is not the same as maximizing short-term profits. Companies that confuse the two put both shareholder value and stakeholder interests at risk. Highlighted by the research supporting the ideas in the book, “Firms of Endearment,” over a 10-year period, firms that focus on stakeholder interests deliver more than 1,000 percent returns, compared to approximately 150 percent for S&P 500 firms. How’s that for shareholder value? In the same research, “Firms of Endearment” also delivered greater returns over a shorter, three-year period compared to S&P 500 firms. Regardless, firms and managers continue to fixate on delivering shareholder value and chase after short-term profits, trading off magnanimous returns over the long-term for shareholders.

CEO Compensation: Previously identified as both an indicator and driver of short-termism, CEO compensation structures that include a mix of salary, perks, bonuses, and stock performance-based incentives promote irrational behavior such as cutting investments in long-term, sustainable, advantage-creating systems or capabilities. Given that a higher stock price yields more money in their pockets, CEOs may also take excessive risks to artificially drive up the stock price. These types of incentives exhibit “convexity,” wherein the direct beneficiaries — the CEOs — have potentially unlimited upside, with minimal to no downside.

“The more CEOs are paid, the worse the firm does over the next three years, as far as stock performance and even accounting performance,” wrote one of the authors of a study involving Michael Cooper of the University of Utah’s David Eccles School of Business.Case in point: Larry Ellison, Oracle Corp. billionaire and a top-earning CEO, took in $77 million worth of stock-based compensation in 2013, according to The New York Times, after refusing his performance bonus and accepting only $1 in salary. Does this exclusive focus on stock-based compensation motivate the right behavior? Despite the hefty compensations provided to CEOs, Cooper and his two colleagues would argue that the more CEOs got paid, the worse their companies performed.

Boards and Weak Corporate Governance: Lack of accountability systems and weak governance structures enable CEOs and executives to further their own agendas, as opposed to furthering the firm’s agenda. In a 2007 survey of corporate board directors, each serving on an average of six Fortune 200 boards, approximately 90 percent suggested they would back deforestation or releasing unregulated, dangerous toxins into the environment if it meant higher profits. If the role of corporate boards worldwide is to recruit and hire CEOs and assess the overall strategy and direction for the firm, it is safe to say that the short-termism agenda is motivated and enabled by the boardroom globally. Given that most boards are dominated by CEOs from other organizations, a hypothesis is that boards and the associated governance structures have lost their ability to provide unbiased, sound assessments of the CEOs they’re hiring and the strategies being set forth.

Hofstede’s Cultural Dimensions: Geert Hofstede, a Dutch social psychologist, suggests “culture is defined as the collective mental programming of the human mind, which distinguishes one group of people from another. This programming influences patterns of thinking which are reflected in the meaning people attach to various aspects of life and which become crystallized in the institutions of a society.” How does this relate to short-termism? Well, one of the cultural dimensions measured by Hofstede’s research is Long-Term Orientation. According to Hofstede, the top three economies (by GDP – PPP valuation), China, the United States, and India, have long-term orientation indices of 87 (high), 26 (low), and 51 (medium), respectively. For economies such as that of the United States, the propensity to think short-term is built into the minds of managers, which makes this problem a national culture challenge and a difficult problem to solve strictly using regulation, compensation structures, and governance mechanisms.

How long does Warren Buffet hold stocks?

IN YEARS

Current Ideas in PLay to Solve This Problem

Because of the complexity of the issue, a number of potential solutions that address different dimensions of the challenge are offered as remedies. The following sampling of ideas presents meaningful changes that would help facilitate a shift, but all have their challenges.

Is government regulation the right path? Legislation and government oversight can curb unethical and illegal practices, but can it resolve the short-termism behaviors? In response to the massive corporate scandals in the late 1990s and early 2000s, the Sarbanes-Oxley Act increased executive responsibility in the financial reporting process. However, as evident in the previous examples, unethical and illegal practices continue as a method to improve the perception of high performance. Increased regulation can deter some unethical practices and increase the likelihood of identifying illegal activity, but it cannot completely alter short-term focus and actions.

Will changing CEO compensation drive the desired behavior? The replacement of stock options with restricted stock provides a mechanism for setting non-earnings conditions on the execution of the stock transfer. If established appropriately, restricted stocks could focus on long-term value creation such as new innovations or the successful launch of new products. However, because stock options still make up 31 percent of CEO compensation packages, a shift to value-creation compensation will take time. Additionally, changing the mind-set of institutional investors and the pressure they impart on stock performance may be outside the corporation’s control. Although changing CEO compensation provides a mechanism to shift short-term behavior and decision-making, it appears to be a “fix the symptom” solution.

Can more involved and independent boards drive long-term value creation? Recent reports suggest board participation and independence are on the rise. The reports indicate that boards are employing a more thoughtful process in CEO succession by taking time to evaluate candidates and reducing immediate chair appointments for exiting CEOs. In addition, boards are beginning to pay more attention to regulatory and compliance issues. Despite this much-needed shift to executive and board separation, without changes to governance and accountability structures, short-termism will prevail within the organization.

In sum, these potential solutions and others may drive changes in some short-term behavior. However, from our perspective, a transformation within the organization is required to establish and sustain a value-creation culture and deter irrational behaviors.

United States

China

India

United States

IN COMPARISON WITH CHINA AND INDIA

A Deeper Transformation is Required

It is important for corporations to be mindful of the pendulum swing to solely long-term thinking. Consider the drastic shift from the 1970s to today. Short-term checks do offer some benefits. Imagine if short-term-driven implications were discovered at year-end or later. Unethical behaviors would continue, and losses would be more catastrophic. In addition, short-term checkpoints offer immediate information on the progress of your strategy and an opportunity to refocus when needed.

Before instituting a drastic shift, corporations must consider the maturity of their industry and organization. For example, is long-term or short-term thinking more realistic in a rapidly evolving start-up?

Can long-term, value-driven strategies survive in hyper-changing industries? In mature organizations, does long-termism breed apathy and ineffectiveness?

A one-size-fits-all approach is not practical. A corporation needs to assess its internal and external environment, and determine the right levers to institute a value-driven culture with the right mix of short-term and long-term goals. A corporation may decide to implement several of the previously cited recommendations. However, without instilling a value-creation focus in the fabric of the organization, a shift will not sustain. The following are a few initiatives that can begin the movement:

- Stop Providing Quarterly Earnings Guidance (Take Immediate Action). Remove the public driver of short-term thinking. Corporations can supplement this with frequent updates on the company’s strategy, innovations, and other value-adding initiatives. Coca-Cola and Google use this strategy.

- Increase Board and Executive Diversity (Empower the Right People). Create a board and executive team with a mix of values and beliefs (an assortment of Hofstede Dimensions) to reduce the opportunity for short-term tunnel vision. Countless studies show the benefits from diversity, so it makes sense to have diverse teams at all levels.

- Vision and Purpose (Articulate the Why). Shift the organization’s focus from an exclusively financial value perspective to a balanced spectrum that includes financial, emotional, experiential, and social value (as outlined in “Firms of Endearment”). Define a broader vision, articulate your specific purpose as a business through a detailed exploration of your ethos, pathos, and logos, and the entire organization should manifest this vision and purpose through every effort. This mind-set provides a framework to galvanize and/or reinvigorate all stakeholders across the value chain to collectively reap a broader spectrum of benefits.

Drastically changing a corporation’s culture is a large and challenging proposition. It is unlikely a corporation will identify a magic formula or foolproof protection for their achilles heel. However, this notion should not prevent immediate action or the drive to change.