Jabian Consulting recently completed a thorough survey of M&A professionals around the country to take their pulse about why deals succeed or fail, learn best practices for post-merger integration, discover how companies think about what defines success, and much more. The following is a snapshot of the insights from that survey.

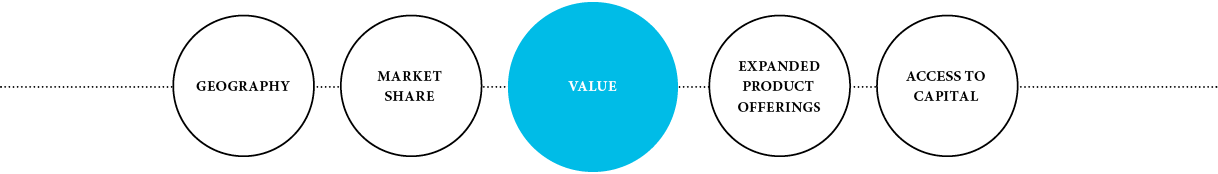

What About Value?

There are many reasons to buy or sell all or part of a company. Geography, market share, expanded product offerings, and access to capital are all reasons we heard from the survey. Very few people talked about value as a primary goal for doing a deal.

96 Percent

of M&A professionals believe that nearly

half of all deals return negative value.

100 Percent

of M&A professionals believe that nearly

half of all deals return negative value.

The degree of difference between how Buyers and Sellers think about various M&A activities:

Agreement

Buyers and Sellers generally agree on a variety of things, such as which department is most often scrutinized during due diligence (Finance), what is the leading factor to potential post-merger value drain (poor communication), and the No. 1 cause for concern during integration (customer retention).

20% Margin

Sellers (93%) are

20 percent more likely to rank cultural fit as critically important to integration teams than are Buyers (77%).

111% Margin

Sellers (38%) were more than

twice as likely than Buyers (18%) to say the deal team going away would be a cause for draining value in post-purchase activity.

126% Margin

When it comes to

sales and marketing managers being involved in due diligence, Buyers (15%) were willing to get the department involved less than half of the time as Sellers (34%).

136% Margin

By a margin greater than two to one, Buyers (52%) over Sellers (22%) reported having an effective, formalized transition plan from the due diligence team to the integration team.

Packed inside Jabian’s Value & Integration Management Office whitepaper are more than 61 insights and critical decision factors relevant to anyone on the buy or sell side of a deal.

The degree of difference between how the most experienced M&A professionals and the least experienced think about various M&A activities:

Agreement

Experienced and Inexperienced professionals generally agree on a variety of things, such as which department is most often scrutinized during due diligence (Finance), what is the main objective of their M&A activity of the next three years (expanding geographies), and the percentage of M&A activity returning positive value (57%).

46% Margin

Experienced pros (66%) we’re almost 50 percent more

likely than those inexperienced to say inadequate due diligence was of great concern when it comes to value-draining activities.

74% Margin

Inexperienced pros (47%) were much more likely to say speed was an important factor in an integration than Experienced pros (27%).

154% Margin

When it comes to sales and marketing managers being involved in due diligence, Inexperienced pros (11%) were willing to get the department involved less than half of the time as those with more Experience (28%).

266% Margin

When it comes to reasons why

some post-merger integrations fail, Experienced pros (33%) were more than three times as likely as Inexperienced pros (9%) to cite focusing on accomplishing

tasks, not value.

Jabian’s Value & Integration Management Office (VIMO™) focuses on the most fundamental, yet often overlooked aspect of mergers and acquisitions — value. Whether you’re on the buy side, sell side, internal corporate staff, or outside investor, Jabian’s perspective on value-focused integrations can mean the difference between success and failure when doing deals. In the VIMO™ whitepaper you have access to:

- The top reasons why deals fail or succeed

- Critical differences between a buyer’s and seller’s post-merger goals

- A guide to avoiding the most common traps companies face during M&A activity

- A proven value-focused framework for approaching M&A activity from pre-purchase through post-merger integration

- Industry-tested benchmarks for your M&A and project management teams