Across the globe, supply chain and procurement leaders have spent more time in virtual boardrooms with their executives than ever before to address the disruption COVID-19 has inflicted on supply chains. Vendor spend has become a critical lever for CFOs to use to tightly manage cash flow. During the peak of government-mandated measures to restrict the spread of COVID-19 (circa March-May 2020), prepared organizations would have been quick to respond by partnering with their vendors. At a Jabian-hosted roundtable in June 2020, procurement leaders spoke to the advantages their vendor partnership programs provided them during this tumultuous time: strong vendor relationships allowed them to renegotiate contracts, manage liquidity, and gain visibility into the extended supply chain to predict and plan around critical materials and service needs. Some organizations, unfortunately, were not as responsive and are still in the early stages of their recovery, purely because of the immature state of their relationships they had with their vendors at the time.

After severe disruptions, most C-level executives conduct postmortems to review key lessons learned and actions taken to protect themselves from another disruptive event. These are the types of questions executives would have asked:

- Why weren’t we better prepared for this supply side disruption? I thought we had great relationships with our vendors and were well diversified?

- We made some drastic moves in cutting vendor spend in line with waning customer demand. How should we be protecting vendor base 2.0? How should we be measuring value versus risk when it comes to vendor partnering?

- Have we exhausted the value potential from our vendor base? Can our supply chain and procurement leaders go back to their “day jobs” now?

What if you wanted to keep the supply chain and procurement leaders at the metaphorical C-suite table? How should they be leveraged to create and sustain incremental value, while balancing supply chain risk?

The Kraljic Portfolio Purchasing Model is a useful framework to shape a procurement organization’s strategy. The model highlights where the biggest areas of value and risk exposure exist relative to the company’s current environment and position in the supply chain. Reviewing and categorizing current vendor spend into distinct categories, then mapping them across the model, will channel efforts to the highest-priority areas. We recommend that our clients revisit this model at regular intervals to ensure that current strategies are aligned to the right priorities.

This exercise achieves two strategic objectives:

- It provides a prioritized list of opportunities to enhance value (e.g., cost savings) and mitigate risk across all vendor spend categories.

- It highlights skill and insight (data, metrics, etc.) investment opportunities across the highest-value or highest-risk areas that would enable vendor strategies.

To bring the model to life, we will use a fictitious U.S.-based company called “Earl’s Pizza Company” (EPC). EPC is a market leader in the gourmet frozen pizza market. It sources its raw materials from all over the globe to appeal to its customers’ ever-growing need for convenient “at home” authentic Italian-style pizza.

Category Mapping and Prioritization

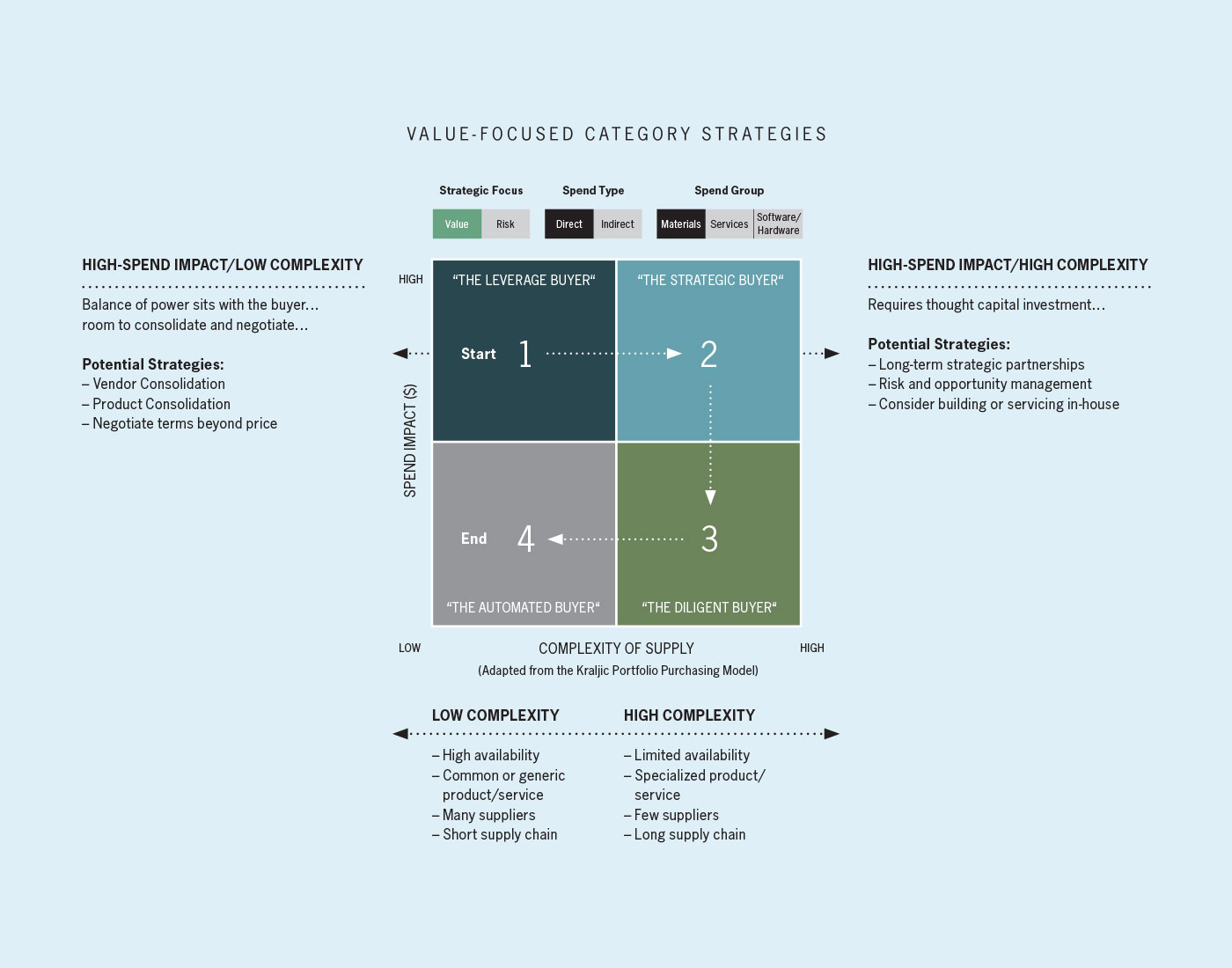

Figure 1

Focusing on value during stable times

When the organization’s “strategic focus” is on “value,” the priority should be on maximizing time and money in the “leverage buyer” (priority 1) and the “strategic buyer” (priority 2) quadrants before focusing on the other quadrants (see Figure 1).

The focus on “value” is a result of the economic, social, and political factors being in equilibrium—these factors influence the stability of the materials and services a company sources externally. High-spend items (y-axis) have a significant impact on the company’s financial performance. These materials contribute heavily to its overall spend, as these are the core ingredients of the pizza it sells to the end consumer.

Cheddar cheese is an example of an item that sits in the “leverage buyer” quadrant. This is because cheddar is a core ingredient for EPC, and a high-spend item. Cheddar is sourced locally in the U.S. with over 50 suppliers to choose from. There is a high availability of supply and a short supply chain, given there are few intermediaries engaged in delivering the product to EPC. These characteristics display low “complexity of supply” and hence put the buyer in a position of leverage. This enables the procurement organization to participate in the following strategies:

- Consolidate order volumes to one or a few vendors to increase bargaining power; the organization is in position to be more aggressive on pricing if its typical order quantity increases.

- Consolidate products/SKUs where permissible to increase bargaining power with the supplier; only when product differences are minimal and substitution has a low impact on the customer.

- Depending on how fierce supplier competition is, this opens opportunities to pull other value levers, such as negotiating lead times (“just-in-time” delivery) and requesting flexible payment terms.

The “leverage buyer” quadrant provides a lot of low-hanging fruit and is where most of the vendor savings potential can be found. The procurement organization should revisit opportunities at high frequency to sustain these benefits. The amount of “leverage” is a relative term; if EPC consumes a larger quantity of cheddar cheese relative to other organizations, it puts EPC in an even more powerful position when negotiating with suppliers.

Moving to the right on the “complexity of supply” axis are EPC’s “strategic” spend categories. These items also drive high spend for the company. One of EPC’s major selling points is that it sources authentic buffalo mozzarella from Italy. Only a few suppliers in Italy meet EPC’s desired grade of mozzarella, so this adds a high level of complexity to EPC’s operation but, in return, is a key differentiator and generates high levels of customer utility. This item is limited in availability, given the small number of suppliers, but there is additional supply tension driven by the long supply chain, given the distance the product needs to travel and the number of intermediaries it needs to pass through, such as border health and safety checks.

The balance of power in this case sits with the supplier. The procurement organization should therefore consider investing in some of the following strategies:

- Develop internal strategic relationship management capabilities to generate long-term trusted relationships with these vendor groups.

- Develop a dedicated function that manages risks and opportunities by exploring market suppliers and conditions in order to provide a higher degree of agility and responsiveness.

- Enter a capacity reservation agreement where dedicated capacity can be ensured by paying a premium charge to the supplier.

- In some cases, the organization might consider producing or servicing in-house as opposed to procuring or outsourcing. Unfortunately, this is not a consideration for EPC given its requirement for authentic “Italian” mozzarella.

In the case of EPC, it is therefore critical to invest in people and tools to perform these types of strategies to sustain value from the mozzarella category.

Category Mapping and Prioritization

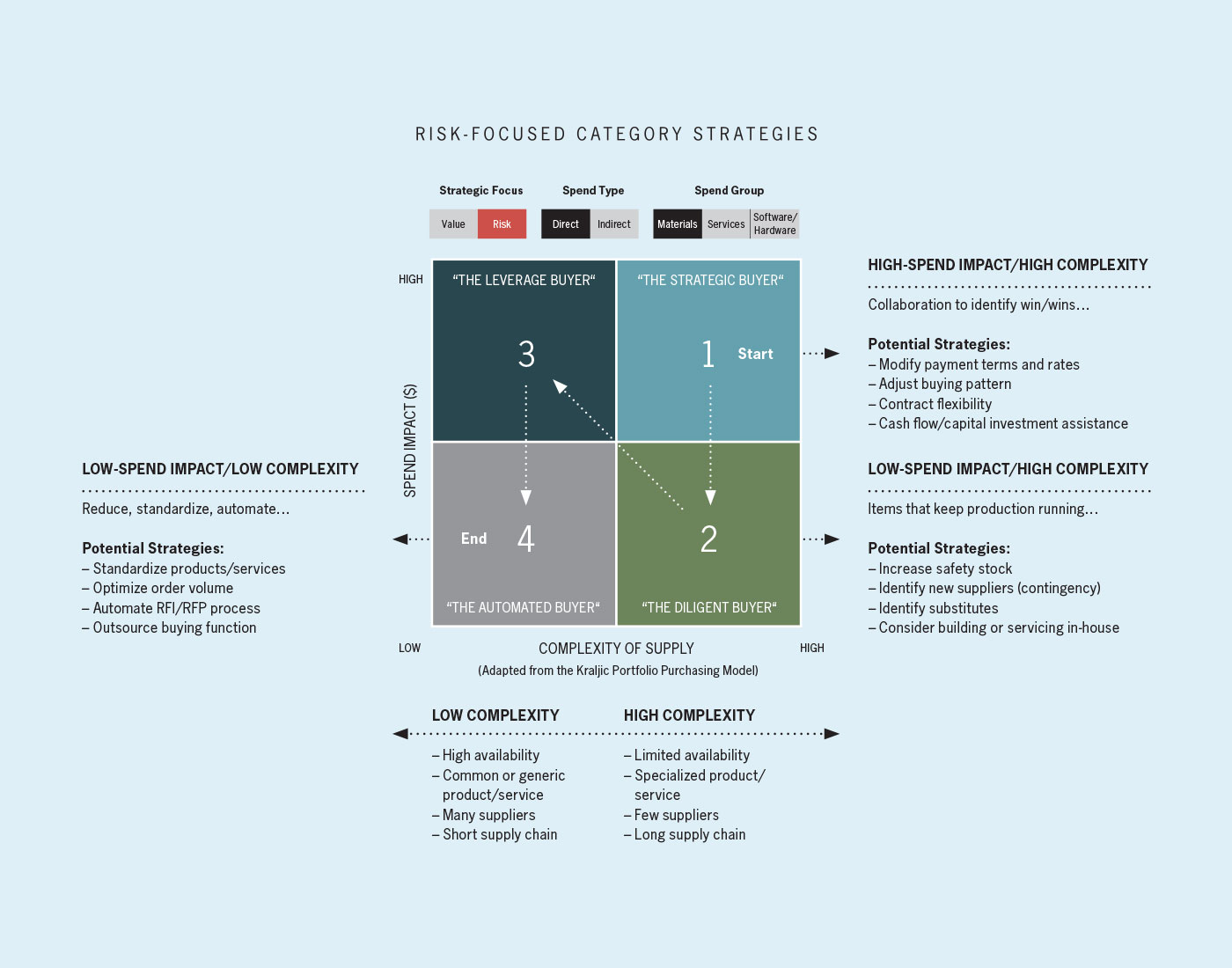

Figure 2

Focusing on risk during times of instability

During supply side disruption, an organization should focus on “risk” over “value.” Triggers of risk could be trade tensions, pandemics, or natural disasters. During these challenging times, the organization should shift its focus to protecting itself from the effects of supply disruption to avoid operational and financial harm. Example impacts include skyrocketing prices due to supply shortages, delivery delays due to stricter border controls, or not being able to source materials due to supplier operations being temporarily closed.

When the organization’s “strategic focus” is on “risk,” the priority should be on maximizing time and money in the “strategic buyer” (priority 1) and the “diligent buyer” (priority 2) quadrants before focusing on the other quadrants (see Figure 2).

If supply of the specialty mozzarella (a “strategic buyer” item) were to be disrupted, it would have a significant impact on EPC’s financial performance given that 80 percent of its pizzas require this ingredient. In this scenario, having invested in a long-term strategic partnership will pay dividends. However, sometimes the supplier could be directly affected. Look at COVID-19: Italy was terribly impacted, and the people containment policies would have directly impacted mozzarella production. The procurement team would have needed to respond creatively by designing win-win agreements with the supplier to guarantee supply or to share the financial burden to keep both parties in business. Some examples of strategies would be:

- Modify payment terms and rates.

- Adjust order size and frequency.

- Relax certain service-level agreements.

- Freeze penalty conditions.

- If the supplier was in financial turmoil, provide possible cash flow or capital investment assistance.

EPC is extremely dependent on the success of this supplier and therefore has an interest in partnering with this supplier during bad times.

Moving down the “spend impact” axis is EPC’s “diligent buyer” quadrant. These items have a low-spend impact, but they also possess the characteristics of complex supply. EPC sources its pizza boxes from an eco-friendly cardboard manufacturer, which is another important selling point to their green-conscious customers. “It’s great for the brand!” the founder and CEO proudly states. This item is considered inexpensive (low-spend impact) to procure; however, it’s considered a “bottleneck” item in that if EPC ran out of pizza boxes, it would not be able to run the production line. What makes this item highly complex is that there aren’t many eco-friendly pizza box producers. Given the risk this poses to the operation, the “diligent buyer” should perform the following strategies:

- Overorder at opportune intervals (build safety stock).

- Identify backup suppliers as a contingency measure.

- Identify substitutes (e.g., eco-friendly plastics that perform the same function as a pizza box, as long as they sustain the “green” brand emphasis).

- Consider manufacturing this item in-house to fully safeguard EPC from this supply risk.

A quadrant that has not yet been addressed is the “automated buyer.” It will always be the lowest-priority quadrant when the organization’s “strategic focus” is on value or risk. These spend categories are low on “spend impact” and “complexity of supply,” and should absorb the least time and money. Sadly, this quadrant often consumes people’s time given that these items, like cleaning supplies and office stationery, must be ordered regularly. The organization should consider the following strategies:

- Standardize items as much as possible, for example, by limiting personal preference in the selection process.

- Invest in automating this job function through auto-replenishments (eSourcing tools) if the materials are consumed at a standard rate.

- Consolidate monthly order volumes; if order quantities are consistent, this should provide some marginal savings and reduce repetitive effort.

Through standardization, automation, and increasing order volume, the organization can find labor savings by removing unnecessary manual effort or by redeploying that effort to more strategic areas of the procurement function.

Investing in the procurement organization: Where to focus first?

Often small, otherwise known as lean, procurement organizations aren’t set up to cover the entire spectrum of value and risk. So, where should they focus first?

Two of the biggest considerations are:

- Alignment to the short- and medium-term strategic vision of the organization.

- Maintaining a “current state” view of its supplier spend portfolio and investing in the biggest areas of value creation and/or risk exposure.

The strategic vision will inform how the company is positioning itself relative to changes in customer needs and wants, and changes in the competitive landscape. Procurement leadership should be engaged in corporate strategic planning activities so that it gears its internal investments toward the strategic objectives of the organization.

Maintaining visibility into the “current state” spend portfolio can be achieved by leveraging the Kraljic Portfolio Purchasing Model once again. Comparing optimal versus current procurement skills and insights (data, metrics, etc.) across quadrants will highlight gaps that should require investment consideration. The investment can come in the form of the following:

- SKILLS: Sharpen buyer skills through structured trainings or attending conferences to deepen knowledge in important spend categories.

- INSIGHTS: Determine the data and information required to successfully manage a spend category. This includes vendor KPIs, market intelligence, geographical indicators, etc. Having visibility into the right insights is a key enabler to anticipate supply shifts and respond with appropriate actions.

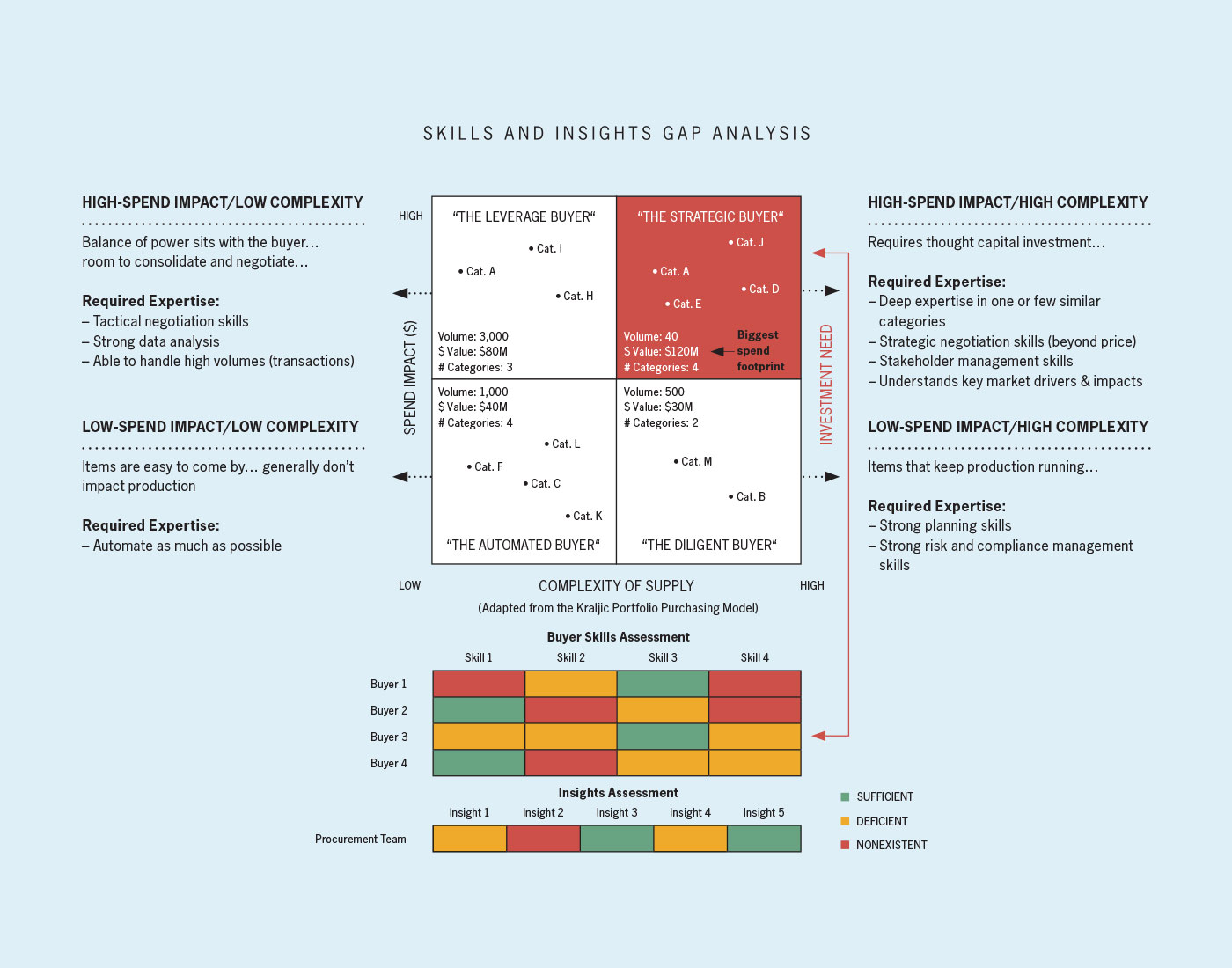

Figure 3

To illustrate this concept, Earl’s Pizza Company (EPC) spends $120M annually on specialty cheeses and meats it sources from Italy (“the strategic buyer” quadrant), which is its biggest area of value and risk. When conducting a needs assessment against the current skills and insights within this quadrant, it is apparent that there are some gaps (red and orange). Figure 3 above represents some skills and insights that are nonexistent (red) or deficient (orange).

The organization should consider training in this area or hiring a procurement professional with those skills. Additionally, some gaps in certain insights don’t give the buyer 20/20 vision over key spend category drivers. For example, EPC doesn’t have visibility to critical geographical indicators (e.g., trade and cross-border tensions) and capacity indicators (e.g., data on Italian Mediterranean buffalo milk production), which makes it difficult for the company to manage and respond to those key spend category drivers. These are opportunities EPC should consider investing in.

Procurement or supply chain leaders should maintain awareness of the driving forces that shift priorities and then invest in the appropriate skills and insights. If not, the company could find itself in a reactive mode and at a strategic disadvantage to its market competition.

In recent times, many organizations have treated the procurement function as a cost center, or as a vehicle to “bully” suppliers and demand cheaper prices.

But as supply chains become more complex—and volatile with new disruptors—expect to see the mindset shift. The C-suite will be more reliant on the voice of their procurement and supply chain experts to ensure that the organization focuses on the most important strategies to sustain value and protect their business from unwarranted supply risk.