If the pandemic of 2020 has taught the C-suite one lesson, it’s that too much working capital (primarily cash held in inventory and receivables in excess of payables) poses a real cost to an organization. Sure, preserving cash has always been an important task, but it’s typically left to the finance and accounting teams during long periods of status quo. During the pandemic, however, cash has become so critical to business success that it’s taken center stage in boardrooms and dominated senior leadership discussion across the globe. Executives have been forced to make hard decisions, often weighing the difficult tradeoff of short-term and long-term consequences. And while many leaders were able to preserve cash for themselves, doing so often added stress to relationships, vendor networks, and even customers who have less cash in their pocket.

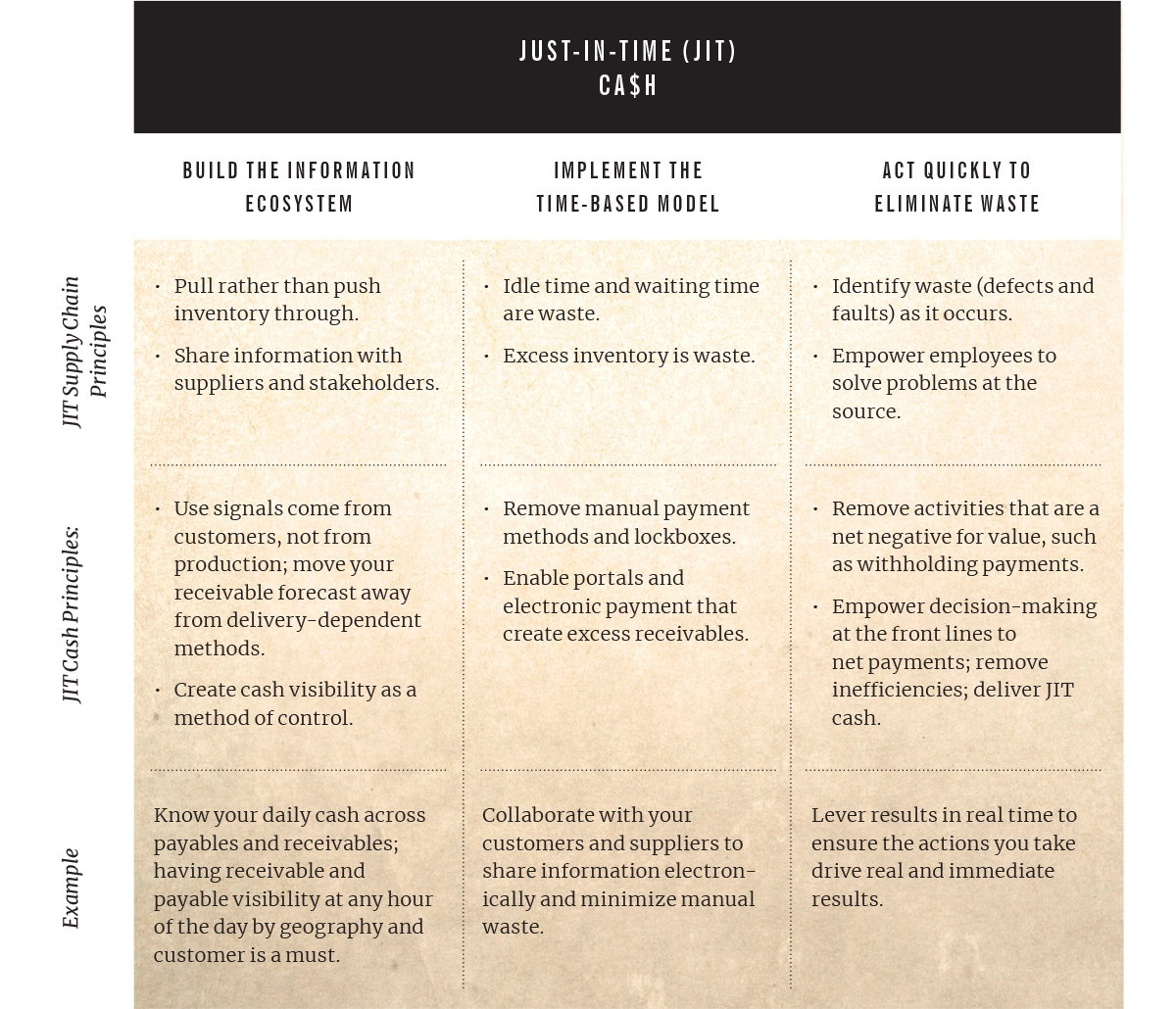

One of the benefits of this increased focus on cash, however, is that the finance function has gained more influence within organizations. As such, finance executives have been afforded more leeway to drive the enterprise investment strategy to make the best use of limited cash. And one such strategy is to adopt the concept of Just-In-Time (JIT) cash — or applying supply chain principles to cash flow — by building the information ecosystem, implementing a time-based model for working capital, and acting quickly to eliminate waste.

The Problems With Competitive Posture

Before we can delve into how business can apply JIT principles to cash, it’s important to explain where the problems arise in the current system and where change is critical. In order to drive the future of finance leadership, the business must first change the dynamic from a constant push and pull between payables and receivables to a discussion centered around bargaining power and negotiation. This fundamental mind shift moves executives away from a competitive posture and into a “better for both parties” agreement. Note that a challenge immediately arises here, however, because of the way buyer-supplier interactions typically work. Both the buyer and the supplier tend to treat each interaction as a zero-sum game and an opportunity to negotiate and take their own advantage with competitive dynamics. This competitive posture based on preserving your own cash position alone doesn’t work. Allow us to explain why — and what you should do instead.

Revisiting The Beer Game

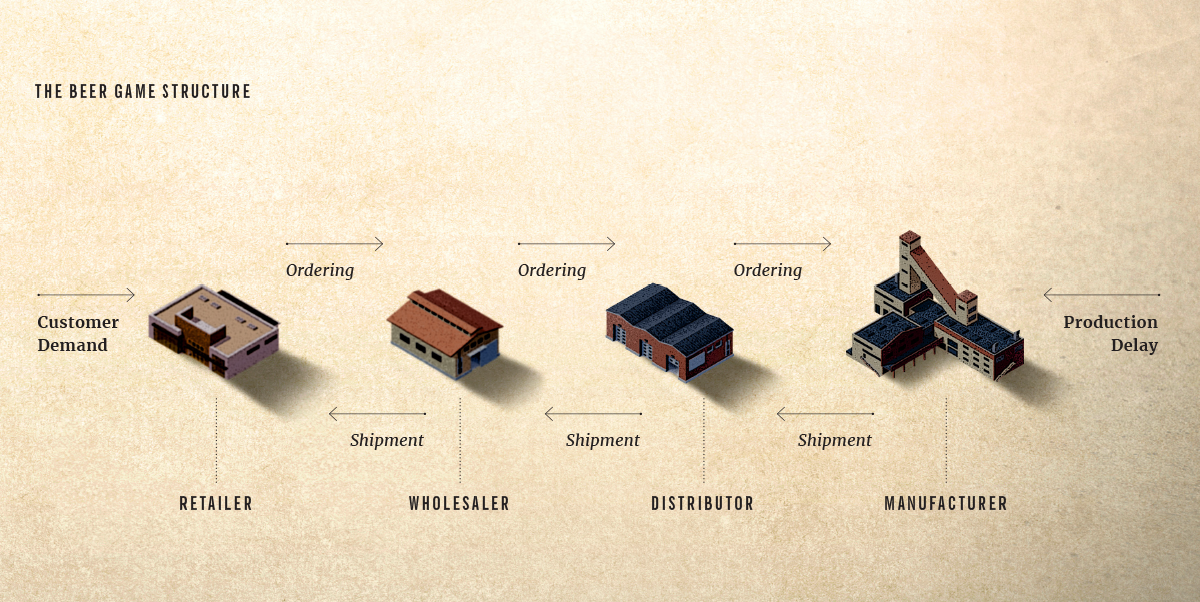

First, let’s illustrate the point by using an example from the supply chain industry. And to do that, let’s play the Beer Game, which was invented in the 1960s to illustrate how critical it is to have accurate and timely information across a supply chain. The game is designed so that you are managing one component of a four-component supply chain, including the factory, warehouse, wholesaler, and retailer. Each component has a single decision to make each turn — how much beer they should ship upstream. The goal of the game is simple: Match customer demand exactly and unload excess inventory without creating a backlog. High inventory levels are costly, but stock-outs can cause lost revenue and the possibility of customer churn.

If you played the game before in business school or operations class, then you know what happens. Your supply chain usually starts with an attempt to closely match orders and keep inventory as low as possible to get the most points each turn. And then, something happens — the customer places an abnormally large order. Suddenly, the huge order rips through the entire supply chain and results in massive inventory spikes and a significant backlog. Your safety stock becomes massive, your customer service levels deteriorate, and your team starts to speculate about who must be mismanaging their portion of the supply chain.

Sound familiar? It is not just the supply chain that falls victim to this phenomenon. These same trends repeat themselves within order-to-cash and procure-to-pay processes as well. As accounts receivable balances rise, a ripple effect can be felt through the organization. “Salespeople must be putting in bad orders!” “Order Management isn’t conducting the proper quality control!” “Invoices are being sent out the door with the wrong information!” “Collections and Dispute Management don’t understand the customer!” There’s a lot of finger pointing, but not a lot of productivity.

How ‘Just-in-Time’ Principles Can Solve The Problem

There is, of course, an alternate view to overordering and overcorrecting. But it requires us to move away from the fixed-pie mentality and take advantage of an expanding pie opportunity. One of the reasons the Beer Game remains relevant is that it reminds us that we are a part of a whole system, operating with incomplete information, and often struggling to forecast the future with both upstream and downstream impacts. It’s here that we should take a lesson from leaders in supply chains and learn the concept of “Just-In-Time.”

One current leader in the use of Just-In-Time principles is Amazon, who has been offering on-demand book printing for years. When you order books that Amazon has licensed, they print and deliver the titles in a matter of days and offer their international distribution capabilities for delivery. The concept wasn’t invented by Amazon, though. Just-In-Time was championed by Japanese firms half a century ago, and its lasting power lies in its simplicity.

The basic concept is that every piece of the supply chain — from raw materials and parts to work in progress (WIP) and finished goods — should be pulled through the supply chain rather than pushed. Stated another way: Goods (and services) should be delivered when they are ordered and not produced in advance to create excess inventory. Why? It’s simple — to eliminate waste.

Excess inventory is waste. It is money that’s sitting around not being sold or used for finished goods, and it ties up working capital. But there’s another form of waste that is commonly overlooked … time. The amount of time goods sit in an unused state is as important as the lack of use. And time is money.

every piece of the supply chain should be pulled through the supply chain rather than pushed.

3 Steps to Applying ‘Just-In-Time’ Principles to Cash

With better information, agreements, and alignment at every stage, supply chains have changed the way they manage waste. This raises two questions: Could finance borrow and apply the same principles? And if so, why haven’t they already done so?

Money sitting in receivables is waste. Money held in payables, potentially with discounts available, is waste. Some organizations even choose to hold onto cash and not pay vendors, further encouraging them to not pay other parts of the ecosystem — again showing the degree to which organizations have embraced a “fixed pie” mentality, which leads to another analogy from the Beer Game: the Bullwhip Effect. It’s what happens when excess orders ripple through the supply chain and create imbalances without leveling out our receivables and payables.

There are three keys to pulling just-in-time principles into finance in order to efficiently manage receivables and payables and avoid the Bullwhip Effect across your business, suppliers, and customers. Let’s look at each:

One

Build the information ecosystem

- Traditional receivables rely on goods delivery or invoice generation. But as the order is the real trigger and should be entered as part of order management, it’s smart to prepare your cash management forecast farther upstream.

- Traditional payables rely on invoices received, but invoice triggers should be known per contractual obligations, and procurement should be required to identify them. As contracts are notoriously difficult to manage, your organization may need to mature the way contracts are gathered, stored, and controlled.

- Cash visibility should be at a minimum 90 days out, with the next 30 days accurate within single digits if not a few dozen points. Visibility is essential for control in the cash game.

TWO

Implement a time-based model for working capital

-

Any element that introduces additional time into the receivable and payable system is waste. Remove manual systems, lockboxes, and mailed checks.

-

Create a method for communicating precise payment dates. Today’s payable and receivable system is like operating a black box: “Send an invoice, something happens, then there is cash in account.” This behavior must end. Your supplier should know the exact day you expect to pay them without having to pick up the phone.

THREE

Act quickly to

eliminate waste

-

Traditional levers like extending terms or withholding payments only get you so far and, over time, your organization may gain a reputation as a bully in the industry. These net negative mechanisms are called value grabs — ways in which a single side can extract value unilaterally. Smart leaders instead move toward levers that create transparency.

-

Your front line should be making balancing decisions every day, but in many cases, these resources are bound to a hierarchical escalation and approval system. Empower teams to operate effectively with alignment to the information ecosystem — and have them see results in real time.

The cornerstone of these solutions is to integrate strategy, people, process, and technology. Your finance strategy should rise above the zero-sum game and enable an ecosystem of partnership and action. Your people should be armed and empowered with the right technology that automates processes and simplifies your views. AR and AP data is a cycle between information, matching, approvals, action, cash, and reporting that can feed the expanded pie mentality — change your mindset from a fixed pie to an optimized relationship ecosystem.