This is the era that fostered the birth and the rise of the big-box retailer. The year 1962 brought about the first iteration of this concept with a 180,000-square-foot store at the corner of 28th Street and Kalamazoo Avenue in Grand Rapids, Michigan, operated by Meijer.

That same year, Woolworths, a leader in retail at the time, opened its version of the big-box, called Woolco. Around this same period, on July 2, 1962, a man by the name of Sam Walton opened the first Walmart Discount Store at 719 W. Walnut St. in Rogers, Arkansas. Over a relatively short period of time, as ease of access and availability of retail options expanded, American consumers found their shopping experiences evolving, which, over time, increased consumers’ expectations of their shopping experience as well.

Bring on the Internet

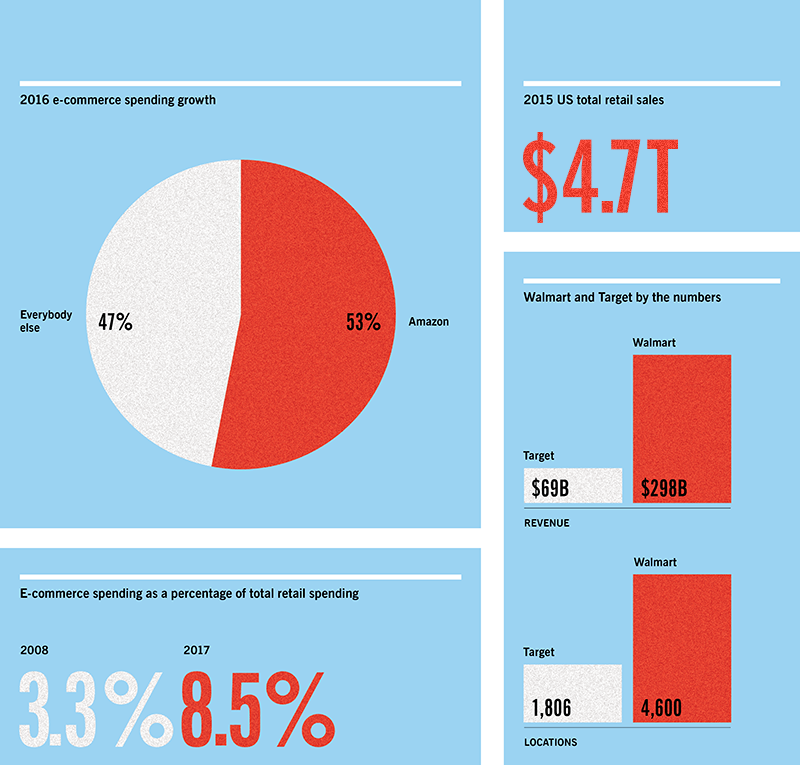

Fast-forward to the present day, and one will find the landscape of American retail has only expanded. The leader in the big-box retail world, Walmart, has more than 4,600 locations in the United States alone, accounting for more than $298 billion (yes, with a “b”) in revenue for the Arkansas-based firm. By contrast, the smaller Target Corporation has 1,806 locations in the United States, generating more than $69 billion in revenue.

According to the Census Bureau of the Department of Commerce, total retail sales for the second quarter of 2017 were estimated at $1,256.2 billion, an increase of 0.5 percent from the first quarter of 2017. Of that amount, the estimate of U.S. retail e-commerce sales amounted to $111.5 billion, an increase of 4.8 percent from the first quarter of 2017. In fact, e-commerce sales in the second quarter of 2017 accounted for 8.9 percent of total sales, and increased 16.3 percent from the second quarter of 2016 while total retail sales increased 4.4 percent in the same period. Between the years 2008 and 2017, e-commerce spending as a percentage of total retail spending has increased from 3.3 percent to 8.5 percent, signaling a steady upward trend.

Much of this growth can be attributed to an ever-increasing consumer demand for customer-driven online shopping, fueled largely by firms such as Amazon, who have recognized a primary pain point for retailers today: Customers’ expectations of their retail experiences continue to shift rapidly, and companies that are not staying ahead of these expectations have an increasingly difficult time playing catch-up.

Reacting to Digital and the Endless Aisle

Amazon was founded in July 1995 in Seattle, Washington, by Jeff Bezos. The company, as most know, started out as an online bookseller, later turning its hand to a broader scope of e-commerce (along with other lines of business, such as cloud data hosting). What people may not know, however, is that, according to a 2017 CNBC report, Amazon accounted for more than 53 percent of online consumer spending growth in 2016. It is staggering, inspiring, and a little frightening to think of a single company drawing this much consumer spending revenue. What’s more, earlier this year, Amazon announced it would buy grocer Whole Foods Market Inc. for $13.7 billion, moving the online retailer into relatively new territory for the world of e-commerce at a large scale. Amazon’s purchase of Whole Foods is unprecedented in that it brings a large-scale established grocery capability into the portfolio of a large online retailer, a tangential acquisition that can leave some wondering about Amazon’s non-traditional strategy for growth.

However, when you take a step back and analyze Amazon’s approach, it makes perfect sense. Amazon’s mission is “to be the earth’s most customer-centric company; to build a place where people can come to find and discover anything they might want to buy online.”

This simple sentence speaks volumes. Amazon puts customers first. Period. Amazon has mastered the art of using customer shopping habits online to create a seamless and personalized customer experience. This expands beyond what consumers are buying and moves into how consumers are buying.

This shift in consumer shopping behavior did not appear overnight and is one that can be traced back to a series of smaller shifts over the history of online shopping. The transition began when pure brick-and-mortar retailers began utilizing e-commerce to expand sales. This brought about a landscape where the physical and online retail spaces were living in silos, a landscape in which the organization of data and inventory became partitioned. Over time, however, technology improved and these silos became operational, and with that, consumer tolerance for partitioned channels began to decrease. The upward demand for a better shopping experience brought about something of a “tearing down the walls,” leading to the birth of omnichannel, a new ecosystem in which the traditional model of partitioned channels evolved into one where products and data moved around channels with the customer. While this opens a door of opportunity, it also continues to pose a challenge to retailers as customers now demand rich and consistent access to product information to help guide their decision process across channels.

Companies like Amazon recognized this early on and focused their growth strategy around these changing customer expectations. For incumbent retailers, this level of competition and disruption requires a shift to the hybrid omnichannel environment that e-commerce provides. The shift to a digital landscape enables retailers to remain both relevant to and competitive with today’s modern online shopper. This model, however, also highlights the need for the right strategy—and the right tools—to fully capitalize on the goldmine that is e-commerce.

PIM: What’s the buzz?

The growth and the complexity of the digital channels in e-commerce creates an ever-growing challenge for retailers to stay relevant and competitive. In the face of the new digital ecosystem of retail and quickly evolving changes in consumer behavior, how can traditional brick-and-mortar stores stay competitive?

One answer may be to explore a PIM solution. PIM—product information management—is a solution that blends business and technology resources to provide a comprehensive approach to managing product content data effectively. PIM combines processes and technologies across an organization’s landscape to present a single view of product content data to the organization, to customers, and to channel partners.

Customers today demand more of their online retail experience, seeking a more interactive shopping experience along with more detailed and more engaging content to aid in making purchasing decisions. Product information management is the customer-driven organization’s tool for reaching and engaging this audience in an increasingly competitive environment.

What makes PIM an increasingly attractive option for retailers lies not in its complexity. It is, in fact, quite the opposite. Good PIM solutions can handle a large sum of product content data and consolidate that data into a single view of a product or product catalog. Great PIM solutions can make the transition between raw product data across a multisystem technology ecosystem more streamlined, and present that product content data in a consumable manner across a complex, multichannel, customer-facing organization.

What makes a PIM solution great? PIM is not a master data management (or MDM) tool—at least, not purely speaking. PIM is designed for the businesses looking to better understand, engage, and cater to their customers, all while having a better internal view of product data across multiple digital channels. PIM solutions work alongside enterprise resource planning and MDM systems to enable business users to tell a strong and cohesive story around their products. They aggregate data from data sources across the organization and product providers to create a single source of truth.

By doing so, product content remains relevant and consistent, regardless of the channel. Consistent data across all channels allows content data to be shared across the organization, which enables alignment in vision and execution of product, marketing, and sales strategy alike.

A PIM solution should not focus solely on the “how” of creating and organizing effective product data. The way data can be organized and used can be addressed by myriad solutions across the data software landscape. PIM solutions should aim to use product content data to drive business strategy, sales, and customer acquisition and retention, as well as tangible outcomes. This is done by enabling some key business drivers:

1. Create an engaging and consistent customer experience through product data.

Customer experience around product content data is the heart of what a PIM solution aims to create. Retailers must engage customers across multiple channels, creating the

need for a consistent message and customer interaction model across all potential touchpoints.

A key hurdle to effectively achieving this outcome lies in the challenge of creating consistent and cohesive product content. PIM creates an effective omnichannel customer experience capable of marrying a unified strategic customer and sales model with accurate and consistent product content data.

2. Automate product content creation to reduce time to market and grow product catalog.

PIM solutions can automate time-consuming processes that may lead to bottlenecks in the scaling of product catalogs or product life cycles, as well as publishing new items to websites. In the ever-competitive world of online shopping, having a large product catalog and frequent product releases can be a massive advantage for a retailer.

3. Support multichannel partners spanning the entire value chain.

PIM provides a consistent and accurate view of product data not only to customers and business users, but also to upstream and downstream partners across the entire value chain. This data can reduce lag time in dealing with manufacturers, warehousing partners, and distributors alike.

PIM Capabilities

Overall, a good PIM solution, whether purely PIM or a combination of PIM and MDM, has the following set of high-level capabilities:

Product visualization:

Product visualization is the key component of PIM that sets it apart as a business tool when compared to traditional data management tools. Product visualization allows product content data to be created or uploaded from various data sources and assigned as attributes to products or groupings of products within a catalog.

These attributes can exist in multiple formats, including text, graphics, or other digital media. This component of PIM enables a single comprehensive and consistent view of a product with multiple attribute types to be published and displayed in an omnichannel environment.

Workflow management:

Workflows are a necessary component to any data management solution. Product information management is no different. A good PIM solution gives the user the ability to create, upload, share, schedule, approve, or reject a workflow.

A strong PIM solution allows for customizable workflows. Workflows can also be exported to external files or sources—fully or partially. Finally, workflows should be presented in a clean and interactive interface that gives the user full control without complicating the experience.

Catalog management:

Inherent to effective product management is catalog management. In short, catalog management gives users and organizations insight into groups and hierarchies of products and how those products exist and interact with one another.

PIM catalog management allows users to create and modify product catalogs so they can map product relationships as well as create product hierarchies and assign catalog versioning. This process can also be automated, which reduces inefficiencies and enables rapid product catalog growth while decreasing time to market for new products.

Update and refresh capabilities:

While this category is not specific to PIM solutions, it is no less relevant. The ability to update PIM software and process new version releases without disrupting daily operations is crucial when evaluating long-run costs that could add up incrementally.

Back-end technical functionality:

This capability refers to a PIM solution’s ability to integrate other relevant data management tools into its core offering. Examples of this functionality include, but are not limited to, data quality monitoring and reporting, ETL capabilities, data syndication, role-based security authorizations, and metadata management. This capability also refers to the ability to mass upload or update attribute, product, or catalog information.

Integration with external content and publishing tools:

PIM solutions were bred to integrate with and operate alongside several data management, ERP, and consumer-facing tools. PIM solutions should be able to integrate with multiple data sources, MDM tools, data quality tools, data asset management tools, ERP systems, and the like. They should also fully integrate with e-commerce tools, web design tools, and other business- or customer-facing platforms.

Highly Configurable:

A good PIM solution should provide the ability for the retailer to configure (not customize) the application to support its business processes in order to leverage the most value from the tool.

Questions to Ask

There are a few key points of consideration when asking yourself whether PIM is the most apt solution for your organization.

First, distinguish between the types of users best suited to a PIM solution versus those who would be better off with a master data management option. PIM is designed specifically for business users who have deeper insight into products, customers, sales, and marketing strategy. MDM tools, on the other hand, are better suited to technical users such as data scientists.

The next two points of consideration go hand in hand: identification of the organization’s existing product catalog and the systems in which those data are stored.

It is crucial that the company’s existing IT ecosystem (both technology and personnel) be thoroughly scrutinized and data organized. This includes considering a realistic timeline for implementation and data migration, as well as accounting for the time and resources needed to sunset legacy tools. Processes should be defined with roles, responsibilities, and ownership identified prior to undertaking the implementation of a PIM solution. This could also include a human capital management aspect of defining and aligning organizational roles and structure. It is, at the very least, frustrating to expend resources on any new solution only to find later that the existing environment is not suited to it. At worst, it can be very costly.

Finally, once these points have been addressed, the organization must decide whether it is better off with a pure PIM solution or a hybrid of PIM and MDM. Pure PIM solutions focus primarily on product content data and how that data can be used to optimally market to customers as well as drive decisions internally. These solutions are heavily tailored to the nontechnical business user.

A hybrid MDM and PIM solution encompasses key capabilities from both PIM (which have been mentioned above) and MDM, which include data integration, data modeling, metadata management, and data linkage. A mature PIM/MDM hybrid includes both front- and back-end functionality for managing and capitalizing on product data.

PIM is still molding its image; companies are releasing new and improved software every day. Whether PIM is the right path for your retail organization, one thing resonates loudly in today’s world: When it comes to e-commerce, the customer is not only always right, but also picky.