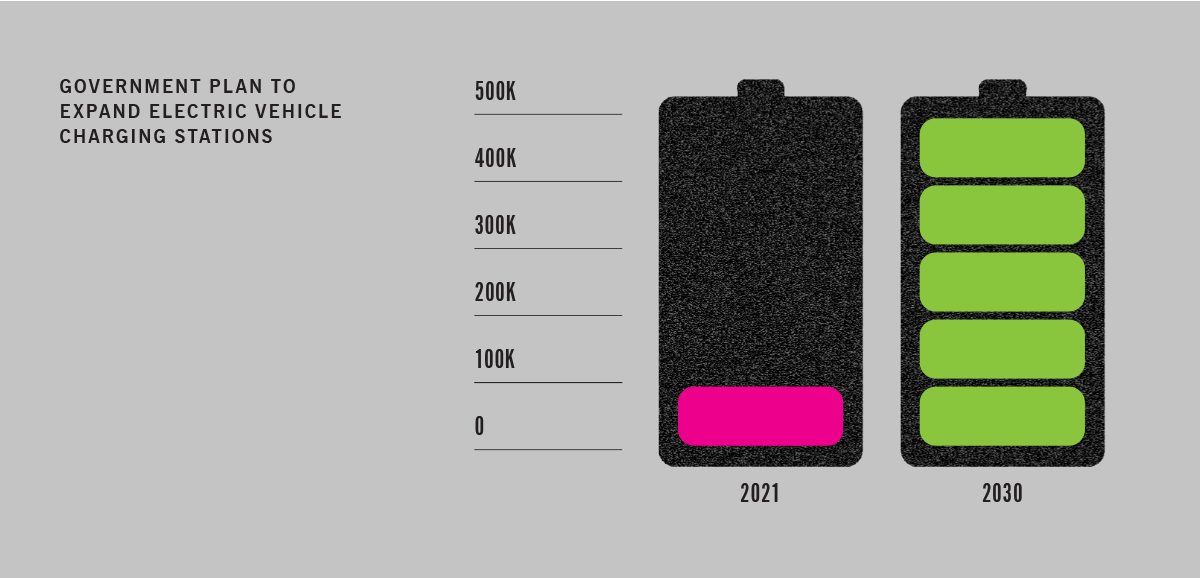

At the time of writing, several details are still being negotiated in Washington, but policies focused on facilitating the growing adoption of electric vehicles are either soon to become law or will continue being proposed until a good solution is implemented. One item in the current administration’s plans is funding to help move the country from 100,000 public electric vehicle (EV) charging stations, as of spring 2021, to 500,000 by 2030.1 Without delving into policy specifics, developing such a large-scale nationwide infrastructure program will surely involve coordination and funding from a wide range of stakeholders. Federal funding can defray a significant portion of costs, but state, local, and commercial interests will have to develop the individual projects that will reach that target.

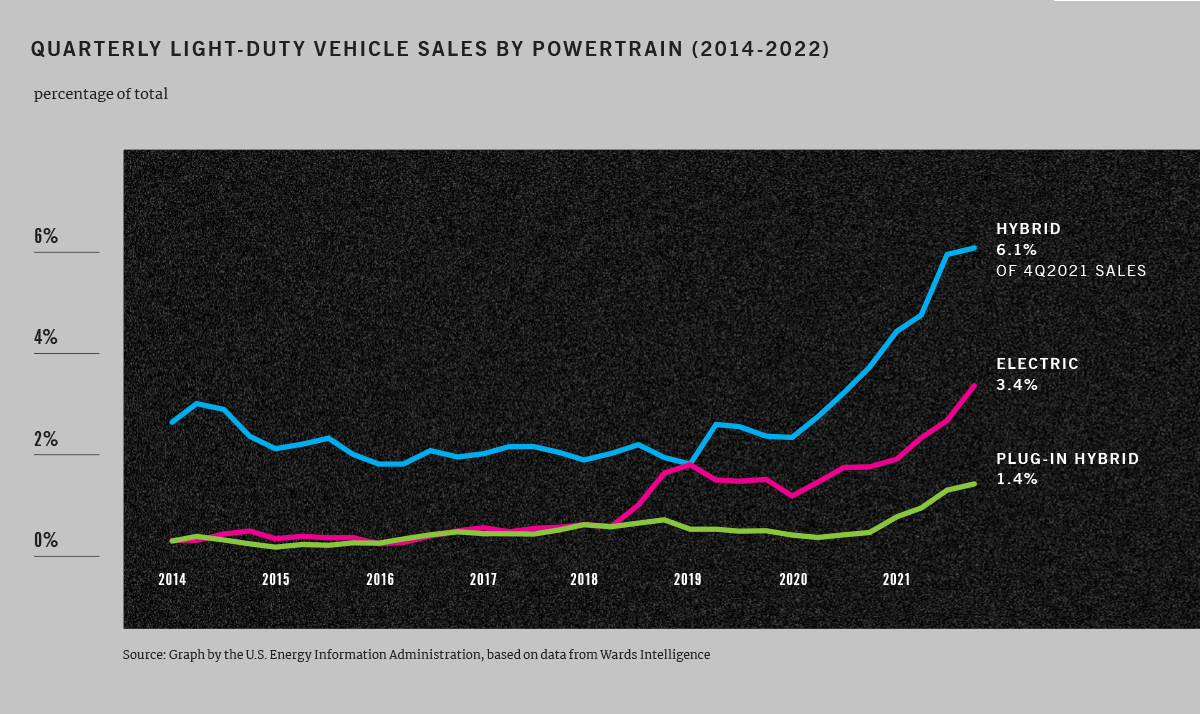

At the moment, there are several major challenges to EV infrastructure development. Perhaps the most significant is the balance between supply and demand. Most individual EV owners will ensure they have charging available at their residence but may not feel able to make longer drives without the confidence they can charge their vehicle away from home. Many consumers may be unwilling to purchase an electric vehicle at all until they feel public charging is nearly as available as unleaded gasoline is today. On the other hand, companies building charging stations don’t want to invest in a massive network when EVs comprise less than two percent of new car purchases,2 as it would be too difficult to recover their investment in an acceptable time frame.

That said, it’s been clear for several years that the EV market is growing. Tesla has become the most valuable car manufacturer in the world, further boosted by a commitment from Hertz to purchase 100,000 cars.3 Ford has already taken 150,000 reservations for its electric F-150 Lightning, although it may take them a few years to fill those orders.4 Regardless of the details of these new federal programs, it seems inevitable the infrastructure will keep developing as well. What are the paths forward? What patterns can be found, and lessons learned from other recent programs that can give insights to EV and infrastructure stakeholders?

The Broadband Success Story

While public-private partnerships are nothing new, their features and principles have evolved over time. In the case of modern problems needing modern solutions, powerful open data analytics has driven recent public-private partnerships to promote broadband access throughout the United States. While these projects are not yet complete, the EV revolution may very well follow a similar playbook, so it’s worth considering some lessons already learned from this space:

Role of the Government: The government, at a state level, in this case, has the credibility and resources to instill transparency and fairness in the buildout of infrastructure. In Georgia, state agency-led efforts allowed private internet service providers to share data and feel comfortable that their competitive interests were protected.

Adoption: When communities were looking to expand rural broadband networks, they partnered with local broadband advocates to promote digital literacy programs and stress the value of them to local businesses and communities.

Skin in the Game: For these infrastructure plays to work, there need to be partners that can see beyond immediate returns and shareholder ROI to the longer-term horizons that align with the interests of the communities they serve. EMCs and local municipalities played this role for broadband, and EV buildout will likely require the same collaboration to truly take hold.

Power of Data: Even with the right organization in place, the most critical play in the playbook often comes down to data. Open-source data played a significant role in Georgia developing the country’s first location-level Broadband Availability Map. Census information, local data on residential and commercial properties, FCC data, and other sources were combined to develop a map that allows communities to identify where there are gaps in coverage based on anonymized provider data and a variety of other data layers. Collecting, interpreting, and relating disparate sets of data unlocks this power, helping communities connect the schools, hospitals, and services that drive quality of life.

Alignment of Commercial and Government Interests

Translating some of this to the EV space, we must consider first how to bring the various parties to the table. A state or local government could have many reasons to support vehicle electrification infrastructure. Not only is decreasing reliance on fossil fuels important to slow the impact of climate change on our communities and the world, but infrastructure development always brings with it the opportunity for jobs. Plus, many local governments are realizing the benefits of electrifying their own fleets5 and will need the infrastructure to support those vehicles. Electrification of light-duty vehicles such as police cruisers is saving cities money today, and some are even electrifying medium- to heavy-duty fleet vehicles such as school buses and garbage trucks.6

Outside the automotive sector itself, EVs and their charging stations may be part of a company’s business model in a range of ways. Many businesses, of course, are adding EVs to their fleets. Developers and others in the real estate industry may want to provide charging stations as a benefit to their customers or employees. And any retail storefront (particularly but not limited to gas stations and convenience stores) may wish to offer charging as a paid service. A business with electric fleet vehicles may even wish to install its own chargers for off-hours use by its fleet and make those chargers available for public use at other times to help defray the installation costs. In all these cases, a business is going to want to ensure that the chargers they are installing (and/or the chargers they intend to use) are in appropriate locations for effective and efficient use.

Among the challenges of EV infrastructure development is identifying those locations. Communities that have made progress have found that the local business community, in collaboration with the local government, can often identify some promising locations.7 However, for a transformation this large to make progress, a more centralized strategy is going to be needed, analogous to Georgia’s efforts facilitating the PPP model for rural broadband. To do this, you’re going to need a lot of data.

Applying Data to Solve EV Challenges

Governments around the world actively collect data to record a variety of information on economic performance, population demographics, environmental indicators, public works, etc. This data, often referred to as open government data (OGD) when released to the public, can be capitalized on primarily through the innovation of information services across a variety of sectors and domains. Innovators make use of geospatial, transport, crime, environmental, trade data, and more to create information services, build business models, conduct market analyses, etc.

OGD is available at most levels of government, including city, county, state, and federal levels. The completeness and timeliness of data depend on the investment in information practices and technologies. Open data portals allow for easy search of datasets that can be downloaded or accessed via API.

OGD together with spatial analytics has been leveraged to solve various problems related to EV deployment. Several use cases have been proposed and analyzed previously.8 These works focused on smart grid integration, required risk management and economic dispatch of the large-scale PHEVs, the impact of PHEVs on distribution networks, architecture and energy management strategies, and Vehicle-to-Grid (V2G) and renewable energy source integration.9

One example of relying on OGD in EV infrastructure optimization is analyzing census and demographic data in relation to traffic thoroughfares to form views on the density of populations and attributes that might make those populations more likely to benefit from charging stations. For example, one could investigate the median incomes by district to determine spending habits or perhaps compare population density, proximity to roadways, and current car ownership statistics. Moreover, it is possible to superimpose vehicle registration data to determine current car ownership and the tendency toward growth of charging demand in each region.

Beyond that case, the Alternative Fuels Data Center (AFDC), part of the EU Department of Energy, provides a wealth of resources regarding existing charging infrastructure and the adoption of PHEVs. The station locator10 tool provided by AFDC can illuminate the need for commercial chargers along specific roadways or in client facilities. OGD provides not only an interesting window into population dynamics but also significant detail about the electrical grid system itself. For instance, the Energy Information Administration (EIA) regularly publishes an Electricity Data Browser11 that conveys both generation and consumption of electricity by region along with high-quality plant data, which provides insight into generation supply. The analysis of this data can yield insights into grid reliability under constraints imposed by EV charging demand.

Challenges and Mitigents

While this spatial data is an easy story to tell, the challenges of developing an EV charging infrastructure go beyond strategic location selection. To name a few possible examples, a large push to install charging stations will require skilled labor that may or may not be available in a particular market. Local permitting rules may not be up to date in a way that allows appropriate projects to move forward at pace. The electricity grid must be able to manage the load of increased vehicle charging, and the utility may even have rate structures that need adjusting. We believe that in all these cases, strategic data analytics can help mitigate the challenge.

Naturally, EV adoption will not be driven solely by strategic infrastructure projects. Consumer adoption will be key, which presents another opportunity for data-driven strategic insights to play a role. Norway is among the global leaders in EV adoption and uses a mix of tax breaks and other incentive programs for individuals and communities.12 Successful execution of the evolving set of programs in this country will likely continue to require a mix of data-based research, stakeholder engagement, strategic planning, customer experience, and change management. Fighting climate change and moving toward an electrified future will be a major paradigm shift in the upcoming decades.