The auto industry is abuzz about the connected car and the advances that connectivity will drive in our future. We often hear how the connected car will affect our travel experiences by enabling autonomous driving vehicles, providing automated real-time traffic data, increasing safety, and allowing more personalization.

With all the amazing functionality the connected car will bring, we often forget about the other industry changes this functionality will bring to the table. How will integrating the automobile into the Internet of things affect the automotive industry?

The connected car’s influence on the automotive industry goes well beyond the driving experience. It significantly changes the industry players and the influence of those players. Wireless data carriers and software giants are poised to become the dominant figures in automotive buying and ownership in the future. Imagine a scenario in which the deciding factor for an automobile purchase is whether it runs iOS or Android. Will your car become an additional device to add to your mobile share plan?

The news is filled with stories about giants such as Apple and Google announcing intentions to enter the automotive industry. Even the ride-sharing service Uber recently stated its intention to build an automobile.

Tesla has continued to make an impact by pushing forward automobile technology and disrupting the franchise dealership model. Mobile wireless carriers such as AT&T are focused on driving advancement through dedicated innovation centers, positioning them as major players in the automotive industry.

While traditional automobile manufacturers continue to control the automotive market, they are slower to react than other industry players when it comes to the automotive future. Look no further than consumer demand for connectivity, personalization, and control to understand why the automotive market is opening to competition. Before we talk about the pressures causing change in the industry, let’s take a moment to look at the automotive industry and its ecosystem.

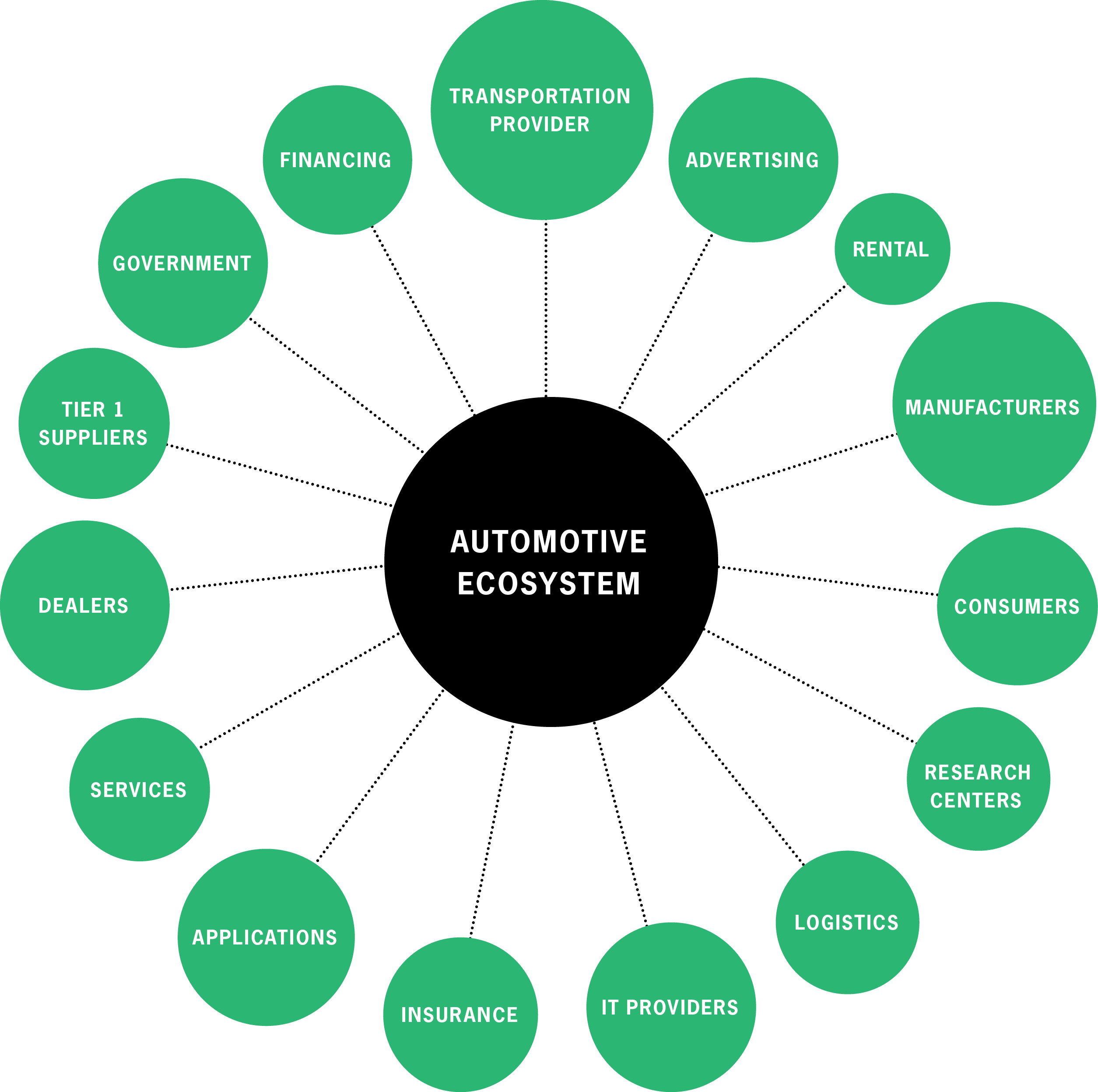

The industry is complex in part because of that large ecosystem. While the manufacturer, dealer, and consumer are the first segments considered in the ecosystem, they are not the only ones. Taking the first step outward, we begin to consider industry segments that maintain vehicles, produce energy, provide insurance, rent or scrap vehicles, and provide transportation.

As we continue thinking beyond the obvious, we realize the industry also drives insurance, financing, advertising, and logistics. While the ecosystem’s network of players is complex, it has remained steady in the last few decades, attributable to the steady expectations of consumers and the success of manufacturing and distribution models. Recently, speaking at a National Automobile Dealers Association event, Warren Buffett said he entered the dealership market because the model is effective and difficult to replace.

So, what happened to the industry to bring giants such as Apple and Google into the mix? This can be traced back to the financial collapse of the mid-2000s. As the country focused on rescuing the banking industry, it became clear that the U.S. automotive industry was failing as well.

In 2008, the Cash for Clunkers program was introduced, increasing the demand for new cars, which influenced manufacturing and helped to get some less fuel-efficient vehicles off the roads. It also artificially inflated the price of used vehicles, reduced the auto remarketing industry, and affected parts and maintenance companies as well. Effectively, the economic shift and the recovery efforts combined to create initial unrest in the automotive industry.

As the unrest began, other pressures began to take their toll on the market. As the common customer’s available cash flow fell, companies in all industries began changing their approach to obtaining and maintaining customer relationships. They offered more personalized customer experiences — and customers began expecting that personalization. We began to see trends where technology and services previously considered optional and luxury were moving toward being necessary and commonplace.

Baby boomers aged, and millennials changed the way we define interactions and experience. Suddenly, there was a need to be very personalized and an expectation to be continuously connected, while the need for face-to-face interactions and communications was decreasing.

The market for data intelligence, software-driven experiences, and constant connectivity was born. The shift to connectivity with others and with the open road caused seismic waves in an industry that had been focused on mass production. How would companies manufacture mass-produced cars, distribute them through a high-touch distribution and maintenance model, and have them operate independently?

The answer: They wouldn’t. This is why start-ups sprang to life, offering mobile solutions for everything from parking and directions to ride sharing and driver scheduling. This is why giants such as Apple and Google are planning to make their mark on the industry.

These new players have not only widened the automotive ecosystem, they have created the opportunity for change across the vehicle value chain. We can assume it will take longer for the end-of-life or salvage piece of the value chain to be affected. When it is affected, the industry will operate in much the same model — though with different parts, technologies, and players.

Similarly, automotive maintenance will take longer to change — good news for dealerships that profit significantly in this area. There are concerns over the long term that newer technologies, such as electric vehicles, will require less maintenance and that the connected car will allow updates and repairs through software and data connections — without dealership interaction.

On the other hand, the marketing and sales pieces of the value chain are likely to remain in their existing channels, though customer expectations have already shifted in this area. The market is adapting and will continue to adapt as more data and predictability become available for this new market.

The distribution and creation pieces of the value chain must respond with the most significant changes in the short- to mid-term.

Breaking down the distribution model, we can look at vendor partnerships and sourcing, as well as inventory management and fulfillment. We have already examined the new players these changes are introducing. Let’s examine some of the changes in execution models.

Players such as Carvana have brought a new experience into the fulfillment model with a focus on frictionless transactions. Customers no longer need to spend time at the dealership. Instead, they interact with a website to set their requests and pricing, then have the car delivered to their home.

Tesla has proven that at its scale, the dealership model can be changed dramatically. It offers locations focused on test driving cars. Maintenance can come through software and/or a mobile repair shop. Vehicles are delivered to the home.

However, the size of Tesla’s market as compared to any major automotive manufacturer brings into question the long-term viability of the model. Time may bring about a significant shift in the dealership model, but it will require changes in the desired customer experience, a move to more real-time inventory management, and automobiles with less required maintenance. However, we can logically conclude that the dealership will have to change from the current automotive distribution model.

This brings us to the creation of the automobile — from market research to R&D to procurement to manufacturing. New industry players are heavily affecting market research and R&D. In the long term, the amount and types of data the connected car collects will also affect this space.

Like most industries, the automotive industry is finding itself overwhelmed by big data, clamoring for ways to leverage the data to predict its future or sell the data to other industries for research. With wireless data and software companies involved in defining the future of the automotive industry, it is likely the industry will be better prepared for this shift. However, traditional manufacturers may find themselves at a significant disadvantage unless they prepare ahead. These manufacturers may be too distracted as they prepare to move from mass manufacturing to creating personalized automobiles.

Examine a future scenario: You find yourself in the market for a new automobile, and your search, of course, begins online. You begin searching for the automobile that best fits your needs. How many seats do you need? What driving range do you need? What energy source do you prefer? What operating system do you want? Who is your network carrier? What seating configuration do you want? As the list of options grows, so do the configurations available for the vehicle. And as your expectations for personalization increase, your willingness to accept standard packages decreases. The automobile production must become more personalized, and the idea of just-in-time creation will be taken to a new level. The industry that brought us lean processes and the ability to mass manufacture at a lower cost structure must now find a way to maintain the cost structure and timeline, while offering more flexibility and customization.

Customers no longer need to spend time at the dealership.

Instead, they interact with a website to set their requests and pricing, then have the car delivered to their home.

While lean principles have been improving industries for years, it is now time for the automotive industry to look externally for guidance. As the industry grows and shifts in the coming months and years, there are a few lessons to consider.

The telcommunications industry found itself in a similar situation as wireless was introduced to the market. The consumer expectation was changing, but the market was well understood, well established, and considered a “utility” of American life. However, what percentage of the population now has a landline? We now are faced with the Internet of things, and a desire for constant connectivity that began with the introduction of wireless and is shaping our lives. As the industry shifted, the telco companies created spin-off companies, took chances for change, and maintained their market positioning as long as possible. As spin-off companies became significant in the market, the parent companies brought them back into the fold. Eventually, the market stabilized with a new set of industry giants.

The banking industry experienced similar effects in the recent financial crisis with similar government stimulus interaction. That industry is also experiencing significant pressure from consumer demand for personalization, the entrance of new players from the technology space, and the need for constant connectivity. Additionally, the banking industry experiences significant data security concerns, something that must be overcome for the connected car and autonomous driving to be successful.

Apple learned that while partnering to distribute hardware is profitable in the short term, consumers expect to be able to use products across platforms, with personalization and custom configurations. This requires working with multiple vendors and partners to enable customers to create the hardware, software, and carrier experiences they desire.

Amazon taught us that the consumer desire to touch and feel a product can largely be overcome by the enablement of frictionless transactions.

While the automotive industry has certainly changed over the last decade, it is being forced to change more rapidly as influences from unfamiliar competitors and consumer expectations learned in adjacent industries begin to impact the market. The most successful players in automotive will be the ones who embrace and guide the change rather than resist it.