From our perspective, four key motivators drive the business model innovation imperative:

- Withstanding the volatility caused by global markets;

- Defending against disruptive, rapid technological innovations;

- Avoiding profit decline as a result of product replication or industry decline;

- Profiting from new, diverse, attractive customer segments.

Incidentally, as we look into the future, evidence supporting each of these motivators continues to call for and even boost the “need for speed” for business model innovation. Sustaining superior performance over the long haul relies on business model innovation. In spite of this, the proper way to innovate remains a mystery for many companies.

There are, however, a few companies that have embraced business model innovation to great success. Examples of these include:

Netflix1

Netflix.com, an online television network with more than 44 million members in over 40 countries, faced industry challenges motivating its business model innovation and investments in original content. Faced with a declining DVD market and a shortage of primary programming because of the dwindling economic benefits for traditional producers, Netflix placed a bet by investing in original content, as opposed to developing original programming itself.

Netflix, valuing the insights derived from its massive database of customer behavior, sought content that best aligned with the interests and viewing patterns of its subscribers. This strategy not only led to commercial successes such as “House of Cards”, which went on to win Emmys and a Golden Globe (Robin Wright as Claire Underwood), but also proved Netflix’s success in extending its business model to overcome industry challenges. Since Netflix started acquiring original content in March 2011, its market capitalization has increased nearly 250 percent.

Diapers.com2

Diapers.com, an online retailer specializing in diapers and baby products, started as a weekend project by two high school friends and grew into a $300 million-plus company in just five years. Its target market was the estimated 12 million American women with children up to 3 years old spending approximately $2.5 billion a year on baby products.

The founders anchored their business model on lean operations (order to fulfillment) to efficiently and consistently deliver diapers to busy parents. Though Diapers.com sells a commodity, it was able to successfully execute on a business model, realize economic benefits, and eventually get acquired by Amazon for $540 million.

Marlin Steel3

In 2003, Marlin Steel recorded revenues of approximately $800,000 selling wire bagel baskets to a highly price-conscious customer base that included Bruegger’s and Einstein Bros. With no barriers to entry, Chinese manufacturers offered steeply discounted prices, thanks to significantly lower costs, forcing Marlin Steel to rethink its business model. A call from a Boeing engineer seeking custom steel wire baskets served as the catalyst for Marlin Steel’s business model reinvention.

Today, Marlin Steel is the leading manufacturer of custom metal forms to a roster of leading industrial companies, including Boeing, GE, Merck, and Toyota. Marlin exports to approximately 25 countries worldwide, outperforming its competition. More than a decade later, the company earns six times its 2003 level.

Drew Greenblatt, president of Marlin Steel, attributes the success not only to that timely order from Boeing, which enabled its business model reinvention, but also to its ability to learn and understand how its products can help its customers –

the first step to any type of innovation.

These examples support the notion that all innovation, whether it would be products and services, or business model innovation, must contemplate three fundamental questions:

- What do customers value?

- How do I provide that value?

- How do my competitors (if any) provide that value?

It all starts with understanding what customers value. Put into action, that means understanding what problems customers want to solve and/or what outcomes they are seeking. The organization must craft a business model that enables it to create and capture value by solving those customer problems or providing the desired outcomes — and then do it all over again.

To start, most business model innovation research and literature suggests anchoring on specific customer needs or problems — the notion of targeting. Before targeting, an organization needs to explore the universal set of possibilities, including existing and new customer segments. Accordingly, we propose using consumption chain analysis as the framework to structure this exploration process to yield business model innovation opportunities.

Figure 1: Consumption Chain

Awareness

When comparing Gillette to Dollar Shave Club, one distinguishing factor between the two competitors is their approach to the “awareness” function. Gillette relies on the consumer to read a blue stripe indicator on the razor to become aware of the need for new blades (pull model). On the contrary, Dollar Shave Club employs a subscription model to provide consumers the offering in a timely and efficient manner – translating the “awareness” function from the consumer into a subscription that aligns to their preference.

Search

What started as a physical DVD rental kiosk

in a few McDonald’s locations has now turned into a business enabled by approximately 42,000 kiosks nationwide — Redbox. The kiosks are within a five-minute drive from approximately 70 percent of the American population. In a digitally connected age where streaming services like Amazon, iTunes, and Netflix provide instant gratification and greater convenience, Redbox has still managed to capture significant market share by providing physical DVD rentals in prime, frequently visited locations, making the search process easy and convenient for the consumer.

Order and Purchase

Dow Corning traditionally provided silicone

to a wide range of customers and bundled into the offering (and price) was high-touch service and support during the sales and distributions processes. Realizing a large segment of its customer base didn’t value the high-touch service and support, Dow Corning created a new business model to cater to these customers and launched Xiameter. Xiameter recognized and addressed the needs of a sizable customer segment by simplifying the order and purchase process and adjusting offering prices via a stand-alone business model.

Payment/Financing

When comparing Gillette to Dollar Shave Club, one distinguishing factor between the two competitors is their approach to the “awareness” function. Gillette relies on the consumer to read a blue stripe indicator on the razor to become aware of the need for new blades (pull model). On the contrary, Dollar Shave Club employs a subscription model to provide consumers the offering in a timely and efficient manner – translating the “awareness” function from the consumer into a subscription that aligns to their preference.

Transportation

What started as a physical DVD rental kiosk

in a few McDonald’s locations has now turned into a business enabled by approximately 42,000 kiosks nationwide — Redbox. The kiosks are within a five-minute drive from approximately 70 percent of the American population. In a digitally connected age where streaming services like Amazon, iTunes, and Netflix provide instant gratification and greater convenience, Redbox has still managed to capture significant market share by providing physical DVD rentals in prime, frequently visited locations, making the search process easy and convenient for the consumer.

Order and Purchase

Best Buy, a multinational, multichannel retailer of technology products, acquired

Geek Squad in 2002 and grew a 65-person organization into roughly 20,000 black-tied and white-shirted tech experts. As consumers turn more and more to purchasing electronics online from a broad and diverse set of retailers, Best Buy continues to diversify its offerings and invest in business model innovations related to Geek Squad — now considered one of its biggest competitive advantages and a business model that provides technical support, repairs, and installation services for rapidly evolving technology products to consumers.

Consumption Chain Analysis

By definition, the consumption chain is the customer’s entire experience with an organization’s offering, from recognizing the need for the offering to disposal or termination of that offering. Exploring what customers value, how an organization provides that value, and how competitors provide that value in the context of the consumption chain reveals gaps the organization can exploit through new business models. The consumption chain is described using 14 distinct activities. Analyzing each activity through the lens of a specific customer segment for each offering is the first step in the business model innovation journey. Figure 1 illustrates the consumption chain and highlights examples of specific business models that capitalize on the market gaps within the respected activity.

Questions for EAch Step in the Consumption Chain

Awareness

How do people become aware of their need for a company’s product or service? For example, Gillette frequently innovates with its products, but it still uses a “pull” business model, where the customer seeks out the product. Meanwhile, Dollar Shave Club, in the same industry, uses a “push” model, where customers don’t think about the need for the product; the “need” decision is eliminated. See page 36 for how Dollar Shave Club accomplished this.

Search

How do people find the company’s current (or upgraded) offerings? Consider the way Redbox sets up kiosks in retail locations and restaurants, for example. See example above, under Figure 1.

Selection

How do your customers make their final selection? Carvana.com, for example, entices customers to skip the dealership when they want a new car.

Order and Purchase

How do customers order and purchase the product or service? See example above, under Figure 1, of how Dow Corning did this.

Delivery

How is the company’s product or service delivered? What happens when the product or service is delivered? For example, TCS creates branchless rural banking using cloud computing to enable low-value transactions to a dispersed population.

Payment/Financing

How do customers pay for the product or service? Netafim provides an irrigation system, but ties payment to the increase in crop yields, rather than the upfront expense of the system. See example above, under Figure 1.

Installation

How is the product installed? Does it require professional installation or do it yourself?

Storage

Is the product stored or consumed immediately?

Transportation

Is the product moved from one place to another? See example above, under Figure 1.

Use

How are customers really using the product? The way Apple has innovated with products that are tightly integrated such as iTunes (music), App Store (developer eco-system and software revenues), iCloud (storage), and Apple Pay (payments revenue) makes switching difficult for customers.

Service and Repairs

What do customers need help with when they use the product? How is the product repaired or serviced? See example above, under Figure 1.

REturns

Can the product be returned or exchanged?

Final Disposal

What happens when the product is discarded or no longer used?

Next Steps

- Create the relevant consumption chain for the product/service lines. Each product/service line may have a different consumption chain. That is completely acceptable.

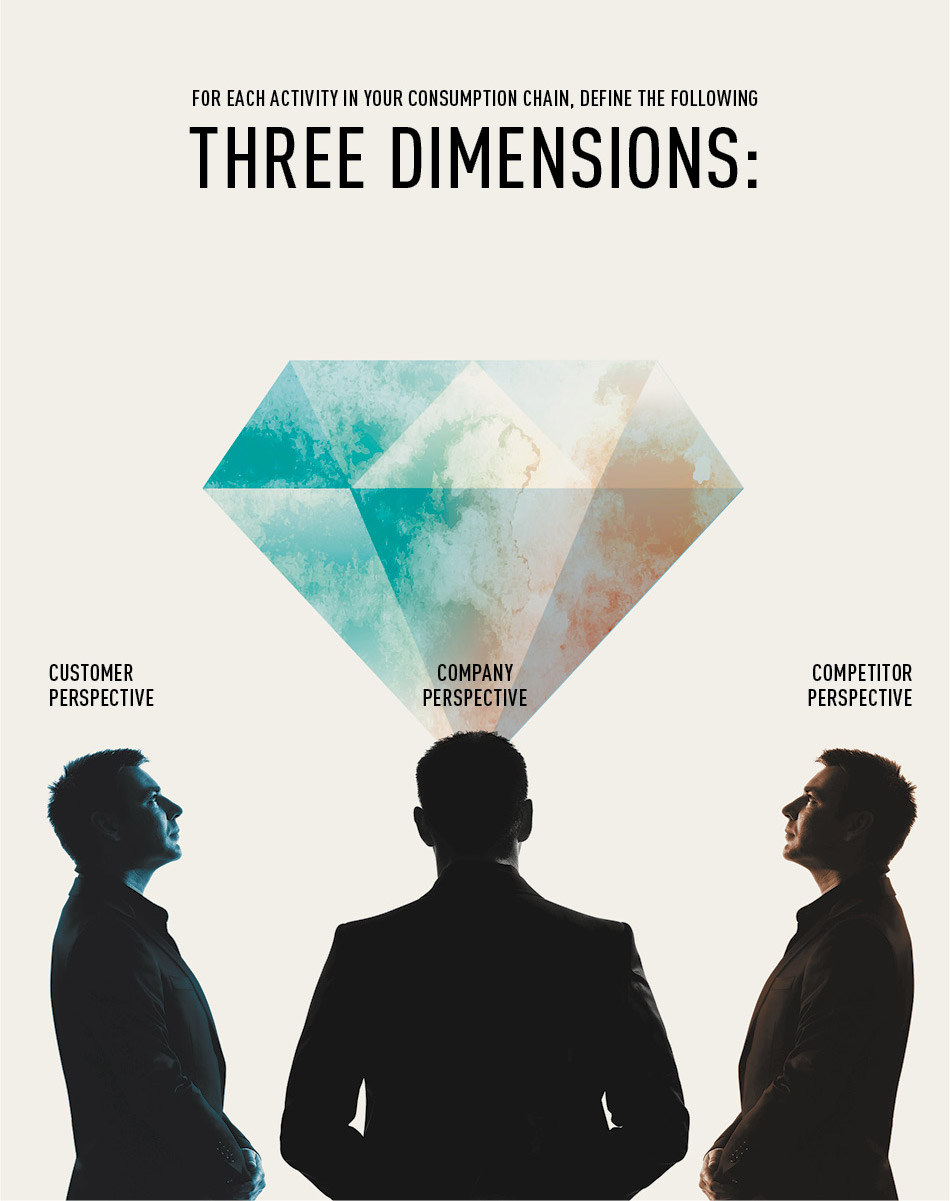

- For each activity in your consumption chain, define the following three dimensions:

- Customer Perspective: How do existing and new customers expect to be served within this activity? What do they most value within this activity?

- Company Perspective: How does the company serve existing customers within this activity? How does it differentiate itself (relative to all competitors) within this activity?

- Competitor Perspective: How do competitors serve their customers within this activity? How do they differentiate themselves (relative to all competitors) within this activity?

- Highlight all gaps and alignment between the following perspectives:

- Customers vs. Company

- Customers vs. Competitors

- Company vs. Competitors

- Engage in a creative exercise to explore the gaps and brainstorm new business models to fill the gaps. Don’t confuse business model innovations with product innovations.

This approach e may sound simple in concept, but requires diligence, focus, and, most importantly, executive sponsorship to stay on course. Business model innovation requires a balance of data and creativity to effectively listen to customers’ needs and values. It requires a blueprint that includes a strategy, capabilities, and resources to deliver products or services that yield economic benefits.

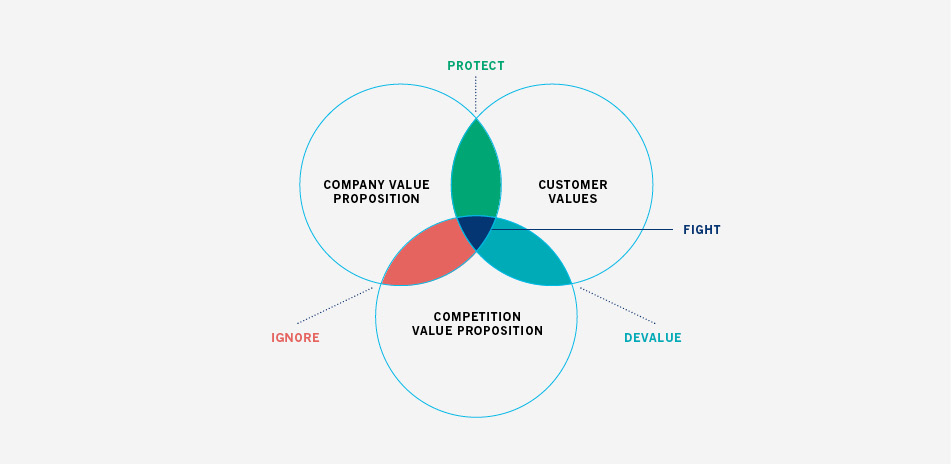

Figure 2: Strategic Action Areas

Customer/Market Alignment

If you were to visually plot the results of the consumption chain analysis the representation reveals key insights and a path forward (see Figure 2). Where the circles overlap define four strategic action areas that companies must address if they are to operate at optimum efficiency and competitiveness:

- Ignore

- Protect

- Devalue

- Fight

Ignore

Represents the shared attributes between you and your competition that customers do not value as differentiators. An example of such an attribute might be a gas station that offers fresh fruit — it can be included in a list of differentiators, but the customer fails to value it since their primary motivators to use your business are location, price, and payment convenience.

Protect

Represents your differentiators that overlap with what customers value and your competition does not provide. An example could be free overnight shipping for online purchases. If your customers value speed, and your competition doesn’t offer this attribute, you can win.

Devalue

This is the opposite of Protect in that it represents what customers value and your competition provides, but you do not. This action requires framing your advantages and differentiators in a way that devalues the competitor’s differentiators.

Fight

Represents the most significant area of focus since it is the confluence of what customers value, and both you and your competition compete on. In this area companies must go above and beyond to secure preference.

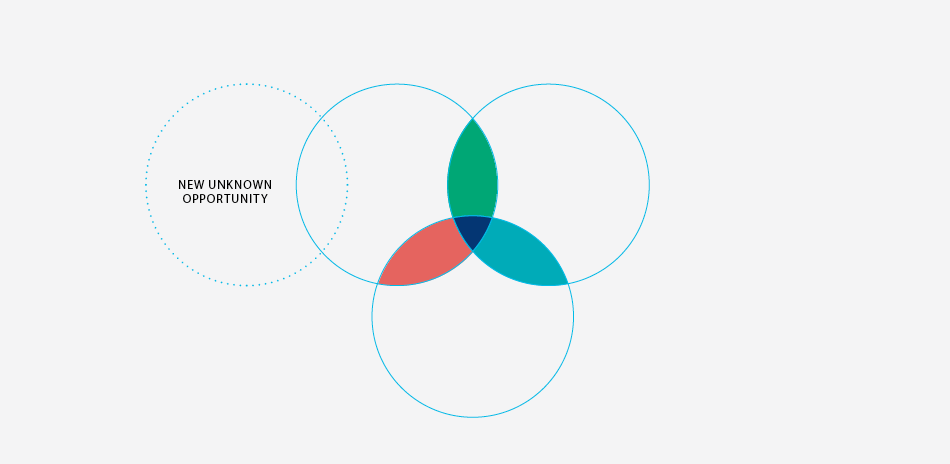

Figure 3: Business Model Innovation Implementation

How to Deal With Each Alignment Area

After performing a consumption chain analysis, the company has its own Customer/Market Alignment model. The basic strategies for dealing with each area are:

Ignore

Customers don’t value these attributes, so the company should stop investing in them. This could be a source for possible divestiture. Do not feel the need to “keep up with the Joneses” if the competition continues to market these attributes to customers. They do not matter.

Protect

This is likely a temporary situation as the competition will either gain these attributes or convince customers they don’t matter. This area is also ripe for innovation, and it’s also where the customer needs the company. Invest in the differentiators in this area. Find ways to innovate to grow the customer relationship through interactions and experiences.

Devalue

Get the customer to think these attributes hold no value. An example of a company that does this very well is Dollar Shave Club. Its advertising reminds customers that a great shave has nothing to do with what famous spokesperson promotes its razors and that overhyped “shave-tech” is just a way to increase the price. The company eventually gets around to the quality of its razors, but its message is almost exclusively designed to devalue.

Fight

This area is a prime driver for business model innovation. The goal of this area is to move as much of it as possible to the Protect area through an investment in understanding everything about the customer and engaging in strategic marketing based on those insights.

By embracing business model innovation, companies can create expanded opportunity with existing clients and open the doors for new unknown opportunities in new markets (see Figure 3). Through analysis and creative innovation, companies should aim to move the Competition circle as far away as possible, while introducing new opportunities through innovation (as referenced by the dotted line).

A Culture of Innovation

In this day and age, business models don’t last as long as they used to, and a business model innovation imperative is critical for creating sustainable growth. Establishing a culture of business model innovation within an organization requires some basic elements for success that can be coordinated and managed by a Business and Innovation Management Office™ (BIMO).

Go back to school.

Company leaders should dare to look beyond what they know and fight oblivion. Learn about as many industries, customers, competitors, and partners as possible. Seek to understand how to help customers and they can help you. Investing in this capability will enable the organization to seek new customer needs to contemplate and develop innovative business models to serve those needs.

Shift the culture to think beyond the product/service.

Among a sea of products and services available to customers in the global marketplace, give customers a reason beyond the product to engage.

Redefine the interaction.

When brainstorming new business models, think about creating experiences, personal connections, and outcomes.

Think coordination, not isolation.

Business model innovation efforts require significant coordination across the organization. Define the business model innovation charter and strategy to promote coordinated behavior, as opposed to isolated, autonomous innovation efforts that don’t take advantage of the broader organization’s scale and competencies.

Develop systems to experiment with your business model innovations.

Any innovation requires focused testing or experimentation. Balance making enough investments to experiment and choosing the right grounds for experimentation before making lofty investments in an untested business model supported only by “gut-feel” or “intuition.”

Get comfortable with failure.

Far too many organizations embarking on innovation journeys end up with bloated portfolios as a result of innovation programs. Define success metrics (measure during experimentation) for business model innovations. Only add innovations that achieve the metrics to support the portfolio. Don’t invest in those that fall short, which requires eliminating the sunk-cost bias.

Don’t underestimate the need for executive sponsorship and organizational change management.

Getting organizations to look beyond the status quo requires strong push from executives and focus on change management. Once leaders make business model innovation a part of the strategy, clearly articulate the vision, the expected changes, and opportunities for the stakeholders to get involved.

By leveraging business model innovation, companies can spend less time trying to constantly develop new products, and more time finding expanded opportunities for existing core capabilities. As companies mature and competition increases, a flexible, responsive, and adaptive business model will be what separates the companies that thrive from those that merely survive.