We have all heard the adage “Those who fail to plan are planning to fail.” Rarely has a saying proven truer than during the COVID-19 pandemic, when some companies that failed to plan for existential events and were slow to respond to a changing market landscape were forced to close permanently. This is readily seen in major retailers like Brooks Brothers that were forced to shutter their doors.

In reality, it was almost impossible for individuals and organizations to have predicted, let alone planned for, such an extreme outlier as a pandemic. However, many could have lowered their overall corporate disruption from the pandemic’s impacts had they thought through potential risk events and how they might mitigate or even use the event to their advantage.

There have always been weak signals of long-tail risk events like pandemics or supply chain disruptions. Throughout human history, we have been subject to countless pandemics, such as the cholera pandemics of the 1800s and the even deadlier Spanish Flu of the early 1900s. The primary reason companies lack a plan for these types of events is the standard three-to-five-year business cycle most companies operate on. A singular focus on growth and daily operations over a shorter timeline can hide these risk events from view. Keeping the likelihood of these events in mind and using signals, like the lockdowns in Asia early into the pandemic, as guide points can help businesses get ahead of the curve.

In fact, tail-risk events are much more common than most realize, so much so that some shrewd investors have both forecasted and exploited them for major profits. For example, Nassim Taleb’s tail-risk hedging investments against the market routs of 1987, 2000, and 2007 created a jackpot scenario from what is normally considered a low probability event. Similarly, George Soros’ short position against the British pound in 1992 net his firm roughly $1 billion in profits on a position that seemed highly unlikely to pay out.

DEFINING RISK EVENTS

GRAY RHINO EVENTSare dangerous, obvious, and highly probable. Yet they are often overlooked because of their steady pace toward our full reckoning. A classic example of a Gray Rhino is the Soros-Pound short position of 1992. George Soros understood that the United Kingdom entered the European Exchange Rate Mechanism in an unfavorable position and that a readjustment would be required. By shorting the pound, Soros was able to make nearly $1 billion for his firm.

BLACK SWAN EVENTSseem highly improbable — or even impossible — based on our worldview and our predilection toward the normal distribution of events. Of course, this is proven untrue when viewed through statistical distribution methods, where events become more common or follow standard patterns over time. It is also exemplified by Nassim Taleb’s long-tail risk hedge position in 1987 which profited approximately $40 million.

DRAGON KING EVENTSare those that lie outside of normal power-law distributions. They are rare events normally caused by the interactions of complex systems. Dragon Kings occur due to interactive circumstances like catastrophic events or tipping points, and they happen quickly and abruptly. In nature, think of rogue waves as Dragon King events, where multiple factors like strong winds, fast currents, and deep waters converge and interact in a synchronistic setup to create an outsized event.

While most companies have neither the means nor methods to exploit tail-risk scenarios like Soros or Taleb did, they shouldn’t ignore them either. In business, change is inevitable, and those who fail to innovate and adapt will be left behind. In 2016, it was predicted that 40 percent of the Fortune 500 will no longer exist by 2026 and that 90 percent of the Fortune 500 companies from 1955 will have shuttered. Those who willfully ignore the trends of history and future probabilities will inevitably fall victim to them.

So, what can an organization do to avoid being shaped by the future?

In short, they can play offense instead of reacting defensively. By applying the tools of Futures Studies — a cross-disciplinary approach to studying possible, probable, and preferred future scenarios — an organization can position itself to benefit from the tides of change and shape its future to reduce risks.

WHAT ARE FUTURE STUDIES?

Since the dawn of human social construction, humans have been thinking about what the future may hold and attempting to divine what causes some societies to collapse while others thrive. The study of the future is pluralistic. Because the future is not the present, naturally, it is composed of many possible alternatives. If there are multiple possible futures, then decisions and time are not linear, and we can ultimately influence the present to ensure a preferred future becomes a reality.

The most commonly understood form of Futures is the empirical-positivist model of trend analysis and future extrapolation. Futures Studies as a discipline spawned out of the comprehensive plans of the First and Second World Wars and has since undergone iterative models, including critical-normative, cultural-interpretive, and empowerment-activist-based futures. All of these models strive to do one thing: incorporate other lines of thought to defeat the inherent biases that arise from taking a linear-structural approach to futures analysis. Today, the emergent model is the Six Pillars framework constructed by Sohail Inayatullah, which aims to go beyond pure analysis and leads toward influencing the future by taking a systematic approach and incorporating multiple disciplines in the analysis of potential futures.

HOW TO SHAPE THE FUTURE USING THE FBAE CYCLE

While shaping the future may feel out of reach, it’s something we do every day. When you write annual goals, make a New Year’s resolution, conduct budgeting exercises, or plan a vacation, you are not only planning the future but also shaping it — assuming you execute the plans.

In a corporate environment, there are annual strategy sessions and concepts like Observer-Orient-Decide-Act (OODA) loops and Plan-Do-Check-Act (PDCA) cycles to facilitate better decision-making. As executives, we often look for frameworks to help us make swift and more consistent decisions.

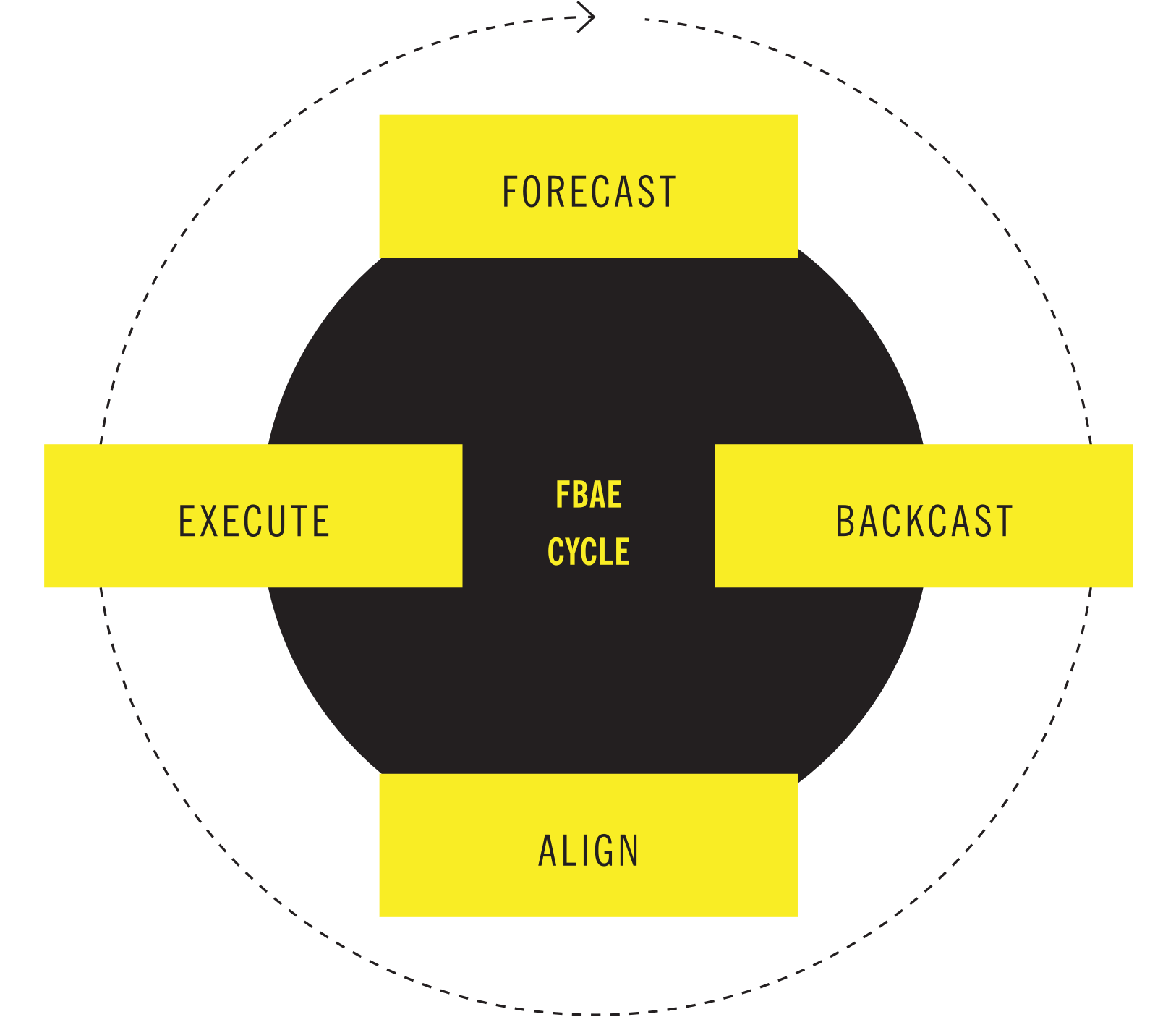

A simple and commonly used framework for employing futures in the corporate environment is the Forecast-Backcast-Align-Execute (FBAE) cycle. Much like the OODA loop and PDCA cycle, the FBAE cycle is about giving leaders a mental framework within which to create a decision matrix and then execute actions based on understood goals.

Forecast

In the forecasting phase, we develop scenarios for multiple alternative futures, typically 30-plus years out. This includes possible, probable, refused, and preferred futures.

As the name suggests, possible futures are those that can possibly occur. These futures can be the most optimistic or pessimistic and require no time limits.

Probable futures are those that are most likely to occur. For example, the global market is moving toward a specific trend; a dominant design is forming; external regulations and controls are narrowing choices and options.

A refused future is the least desired or wanted future, but one that must be anticipated.

And finally, the preferred future is the most desired future and the one that you and your organization will want to influence into reality.

Backcast

Backcasting is where we start to transform the murky future into an actionable reality. Similar to backward planning, backcasting involves starting at the desired future and working in reverse until you reach the present day. It is critical throughout this process to identify the continuous, incremental actions and steps that drive you to the desired endpoint.

Note that these steps will sometimes compound on one another and could include anything from small changes in sales strategies to major IT transformation projects that increase the probability of the desired future to become reality. It is equally important to identify offramps and pivot points where you can correct your course or abandon a designed future if necessary.

Align

Alignment is the phase where actions are synced with the roadmap for the desired future. It includes identifying and outlining specific actions, activities, and changes that must occur today to put you on the right path.

Alignment can involve implementing strategic plans, organizational changes like moving from a hierarchical to a matrixed organization, or behavioral modifications such as performance improvement and optimization plans or new feedback channels. It should always involve implementing or adjusting communication plans.

Execute

This is where the future is shaped. Here, you execute the previously outlined actions and activities, always keeping the goal in sight, and track metrics on shorter-term goals that can compound toward the desired future.

This is also where the FBAE cycle can restart due to internal or external impacts, such as major regulatory or legal changes, new market opportunities, or clear challenges to assumptions that underpin what makes the future goal desirable.

THE FBAE CYCLE IN ACTION

To show how this would work in action, let’s examine the case of a real estate investment trust. As of now, this firm holds both residential and commercial real estate, with both sides currently losing money due to the pandemic. Let’s execute a shortened FBAE cycle to help this firm quickly decide how to respond and become profitable once again.

Forecasting

Our REIT sees four potential futures that need to be examined. To understand what futures may exist, the firm will need to analyze its strengths and liabilities.

1st – They continue down the current path and eventually go under from the debt burden.

2nd – The REIT sells off all the unprofitable properties at a loss and write-down but stems further pain and focuses on just their profitable ventures.

3rd – The firm tries to leverage its internal know-how to open a new professional services business line to assist other REITs and collect consultative and management fees.

4th – The firm changes its current tenancy model to be more flexible and creates more boutique rental agreements across all its real estate holdings.

Ultimately, the firm chooses the last option.

Backcasting

Since the firm has chosen a path of boutique rental agreements, they will have to set into motion several stages to reach this end goal. Moving from the future back to the present:

Stage 3: Create an enhanced contract management system to better track the agreements.

Stage 2: Ensure their processes have been standardized to make the new management system a viable option.

Stage 1: Determine which offerings they will want to make available and look at blockers and opportunities, like failing to find a product-market fit or getting introduced to SaaS companies that can handle the contract management in a way that is desirable to the firm.

Aligning

At this point, the firm will build out its strategic plan and roadmap. They will build up their go-to-market strategy and start communicating the plan to their agents and clients. All of this will also be underpinned by determining where to emplace and cut capital allocations to ensure the highest probability of success.

Executing

From here, the firm sets out on the long road to achieve their future. Senior management will track progress, check for threats and opportunities, and continue to nudge the firm along the path to success.

Eventually, the firm achieves its goal of profitable six-month rentals in multifamily residential and hotel spaces as well as short-term rentals for pop-up shops, events, and business startup hubs, creating new revenue streams that the firm had never been able to capture before and earning them a crowning achievement in profitability and becoming a model that is replicated across other REITs.

SHAPE OR BE SHAPED

There is no way to anticipate every possible event in the world. The future is ever evolving, and there will always be unpredicted factors that influence its direction. But that doesn’t mean business leaders should stand idly by and let the future happen to them.

By utilizing Future Studies and taking direct action through structured frameworks such as the FBAE Cycle, it is possible to impact the direction of the future to your organization’s advantage. By choosing to shape your company’s future rather than be shaped by it, you can bring fame and unrealized profitability, making your company a market leader.

Sources:

- https://www.cnn.com/2020/07/08/business/brooks-brothers-bankruptcy/index.html

- https://fortune.com/2020/09/28/covid-buisnesses-shut-down-closed/

- https://www.cnn.com/2020/07/08/business/brooks-brothers-bankruptcy/index.html

- https://fortune.com/2020/09/28/covid-buisnesses-shut-down-closed/

- https://globalhealth.duke.edu/news/statistics-say-large-pandemics-are-more-likely-we-thought

- https://hbr.org/2014/01/from-superstorms-to-factory-fires-managing-unpredictable-supply-chain-disruptions

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7874133/

- https://www.graduateinstitute.ch/sites/internet/files/2020-09/Ferguson_Dragon_Kings_2020_09_22.pdf

- https://www.linkedin.com/pulse/how-40-todays-fortune-500-extinct-10-years-debora/

- https://fbs.com/blog/nassim-taleb-%E2%80%93-a-genius-mathematician-and-trader-69

- https://arxiv.org/ftp/arxiv/papers/0907/0907.4290.pdf

- https://arxiv.org/ftp/arxiv/papers/1205/1205.1002.pdf

- https://eloncdn.blob.core.windows.net/eu3/sites/964/2019/07/Futures-Studies-Timeline.pdf

- https://wfsf.org/futures-studies-theories-and-methods-sohail-inayatullah-2013/

- https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/985279/effective-systemic-foresight-governments-report.pdf

- https://slightlyeastofnew.com/2013/11/20/pdca-vs-ooda-why-not-take-both/